Between 2024 and 2026, companies have time to comply with the European Union’s Carbon Border Adjustment Mechanism (CBAM). This transition period offers companies a unique opportunity to understand their supply chain and build a competitive advantage in a world moving toward global carbon pricing.

The Great Equalizer

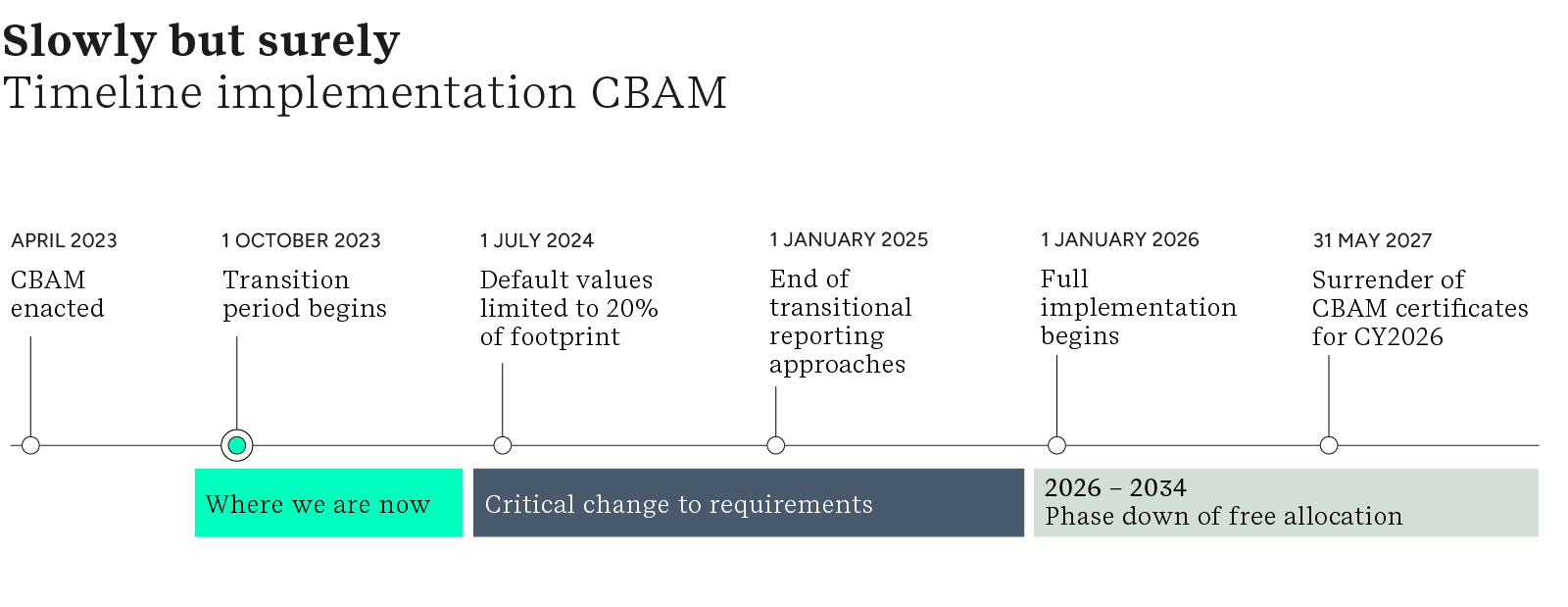

The EU’s Carbon Border Adjustment Mechanism (CBAM) came into force on 1 October 2023. CBAM is the world’s first carbon border tax, launched to help tackle climate change and prevent carbon leakage. Carbon leakage occurs when industries transfer polluting production to other countries with less stringent climate policies or when more carbon-intensive imports replace EU products.

This is the first of two articles on CBAM. Please click here for the second article, which lists 5 steps of how to comply with CBAM and add strategic value.

Initially, the sectors impacted include emission-intensive sectors that are deemed most at risk of carbon leakage: iron and steel, cement, aluminium, hydrogen, fertilizers, and electricity, but it is expected to be expanded to all EU Emission Trading System (ETS) sectors in time.

The EU carbon border tax on embedded carbon will be gradually imposed, working simultaneously on two fronts:

- Promote a fair price on the carbon emitted during the production of carbon-intensive goods entering the EU. EU importers will buy carbon certificates corresponding to the carbon price that would have been paid had the goods been produced under the EU's carbon pricing rules;

- Encourage cleaner industrial production in non-EU countries. As such, the CBAM works in tandem with the EU Trading System (ETS), which imposes a cost for carbon on producers in the EU. When fully implemented, the CBAM will require upstream producers and value chain participants to implement EU ETS-like approaches and extend full EU ETS carbon pricing to non-EU production.

Moving from reporting to full carbon pricing

Certain qualifying goods within these sectors imported from outside the EU now fall under the new regulation. The implementation will be divided into two phases.

Transition Phase: warming up the engine

The transitional period, in effect since October 1, 2023, marks the start of reporting obligations. An affected organization’s first report is due on 31st January 2024, with quarterly reporting required afterward. There is no financial obligation during this period, but organizations are required to submit a quarterly report including:

- Total quantity of each type of good imported during the preceding year (MWh for electricity and in tonnes for other goods);

- The total embedded emissions in the goods (tonnes CO2 emissions/MWh for electricity or, for other goods, tonnes of CO2 emissions/tonne of each good);

- Electricity consumption in MWh per tonne of goods imported

Depending on their level of maturity regarding scope 3 GHG data collection and reporting as well as their knowledge and relationship with their affected suppliers, companies can take different routes to comply with CBAM reporting requirements for the first three quarterly reports. They can start reporting using the EU default values and transition to accurate and auditable supplier data as they progress in their supply-chain mapping and engagement. Starting now and leveraging the 2-year transition period is key for companies to understand the financial implications of CBAM and leverage this regulation as an opportunity to differentiate from competitors.

From the 1st of July 2024, importers will be required to use value-chain-specific data for at least 80% of the reported emissions footprint, implying that there is now a 6-month window to establish detailed value-chain accounting and communications.

Definitive Phase: getting real

From 1st January 2025, importers MUST be an authorized CBAM Declarant with applications to the CBAM Registry, and the transitional reporting approaches end, requiring reporting based on the EU methodology only.

From 1st January 2026, CBAM enters the definitive period, with annual declarations of emissions required by May 31, together with surrender of associated CBAM certificates, and independent verification of emissions data. EU importers of goods covered by CBAM will be required to become an authorized CBAM declarant by applying for it via designated national authorities. They will have to make annual declarations of the goods imported into the EU and purchase CBAM carbon certificates for the amount of embedded carbon.

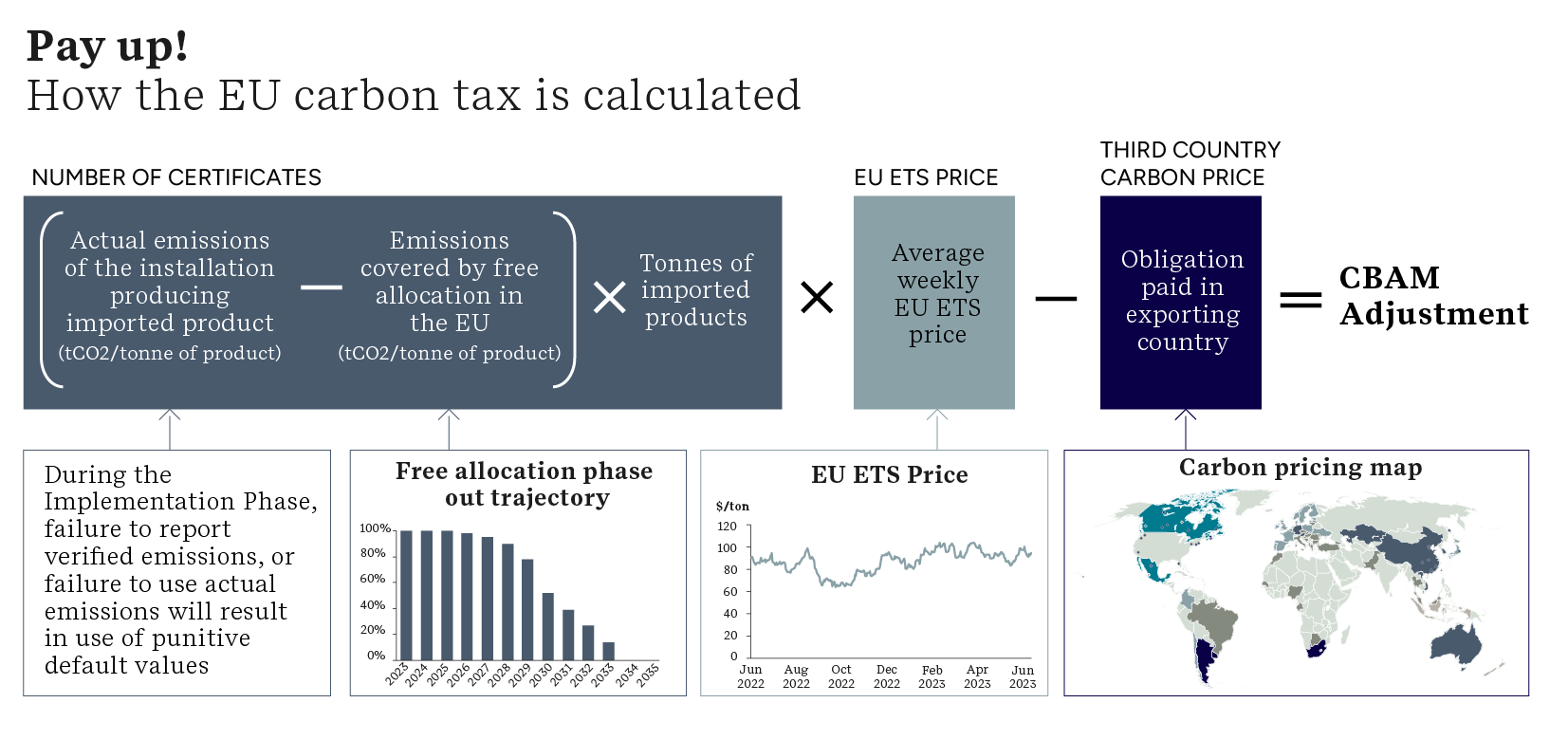

The CBAM carbon price paid by importers is reduced by any carbon price already paid in the originating country so that the total carbon price is equal to that paid by EU producers.

The certificates will be priced according to the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted, which has been forecast (by a variety of forecasters, including S&P Global) as €100/tonne by 2025 and exceeding €140/tonne by 2034 when CBAM free allocation is completely removed.

Company response: use the transition period to your strategic advantage

CBAM should be of interest to organizations’ tax and compliance teams initially but ultimately should attract the interest of CFOs and CSOs to respond to the longer-term challenges as it is crucial to understand both CBAM’s technical requirements and the potential impact on supply chains and company value.

What do companies need to do now?

- Comply with transition phase reporting requirements, where failure to do so may attract penalties of 10 to 50 euros per tonne of imported goods;

- Understand the financial and strategic implications of CBAM and how this will affect their organization and value chain;

- Understand and develop product based GHG accounting approaches across its entire value chain within the specific and detailed boundaries and rule set of CBAM;

- Engage with their suppliers to explain how CBAM will affect their relationship, collect relevant GHG data, and discuss joint strategies to leverage this regulation as a competitive advantage

- Decarbonize to gain competitive advantage and reduce exposure to the full EU carbon pricing in the definitive phase.

- Prepare for the purchase of CBAM certificates.

Key enablers for this definitive phase:

- The digitalization of companies' supply-chain GHG data management to access them in near real-time

- The operationalization of decarbonization roadmaps with access to low-carbon technology implementation know-how

These are significant undertakings requiring investment of time and resource. The effort to understand and develop approaches initially for CBAM compliance but ultimately to thrive in a world where carbon pricing becomes the norm should not be underestimated. Please read our second upcoming article, for a 5-step process of actions to support compliance and support the strategic necessity to future-proof against rising carbon pricing through the development of clear decarbonization pathways.

Author contacts

David Neilson, Associate Technical Partner: David.Neilson@erm.com

Clive Abel, Principal Consultant: Clive.Abel@erm.com

Fanny Guezennec, Principal Consultant: Fanny.Guezennec@erm.com

Sebastian Voigt, Associate Partner: Sebastian.Voigt@erm.com