Investing using ESG principles requires access to reliable, timely, and high-quality data about companies’ ESG performance—but investors often find that data hard to come by.

While popular in public markets for some time, demand for ESG adoption has gained significant traction in private markets. Private equity (PE), venture capital (VC), and other private market participants increasingly recognize the value of integrating ESG principles into their investment strategies. A recent study by the United Nations Principles for Responsible Investment (UNPRI) also revealed that 75 percent of PE signatories assess ESG materiality for individual companies in their portfolios. Investor pressure from LPs and the evolving ESG regulatory landscape are compelling general partners (GPs) to measure the ESG performance of their portfolio companies. Furthermore, a report surveying over 300 limited partners (LPs) and GPs shows a shift towards an "ESG or nothing" investment philosophy, with over three quarters of respondents saying that they plan to cease investing in or promoting non-ESG private markets products by the end of 2025. However, limited disclosures from private companies and the lack of a consistent ESG data collection framework across the private markets make it challenging for GPs to track progress on material ESG goals.

ESG Data Scarcity Challenges

One of the primary obstacles for GPs seeking to incorporate ESG factors into their assessments is inadequate disclosure practices. Unlike listed companies, private companies are not subjected to the same level of reporting requirements, making it challenging to access relevant ESG data. Furthermore, the absence of consistent and comparable metrics hampers the ability of GPs to benchmark portfolio companies and track performance.

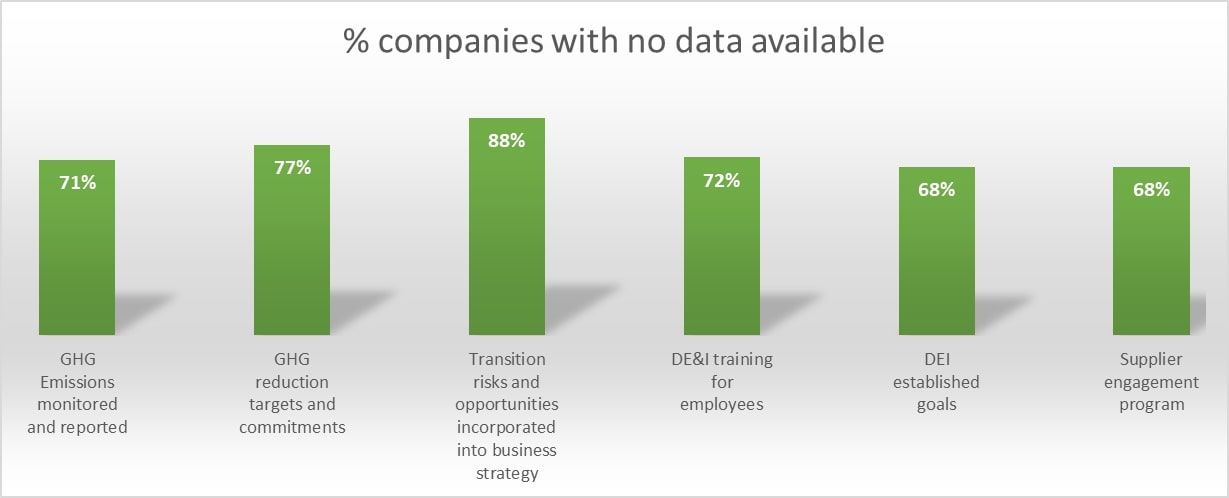

Having comprehensively analyzed and scored over 650 companies for investor clients as part of ESG Fusion, ERM’s flagship ESG assessment tool for private markets, a key trend we observed was the lack of ESG disclosure on companies’ preparedness to address ESG risks. Among those, ESG metrics focused on addressing climate risk, DEI, and responsible supply chain practices had limited reporting. Our analysis found that a large proportion of companies lack data availability on the following:

We recognize that private companies often lack the resources and systems to collect and report ESG information, leading to gaps in data coverage. Adding to this challenge is the reliability and quality of available ESG data. The lack of independent verification and standardized auditing procedures raises concerns related to data accuracy, completeness, and consistency. This could hinder the effective integration of ESG considerations for GPs and may result in misjudgment of their portfolio ESG risks. Acquiring and analyzing ESG data can also be expensive and resource intensive for GPs. The absence of streamlined data collection processes and the need for specialized expertise make it challenging to manage the costs associated with ESG data gathering and analysis.

What are GPs looking for when it comes to ESG information?

GPs usually consider ESG aspects during their pre-investment screening and due diligence phase to confirm prospects’ compliance with their fund’s policy, identify key ESG risks and opportunities in potential investments and outline ESG action plans and reporting requirements. Furthermore, the type of ESG compliance requirements can vary based on the region and size of the portfolio being managed.

Based on responses from existing Fusion clients and external GPs we have engaged with, the following are some of the key aspects they are looking for when it comes to integrating ESG information:

- Risk signals and red flags: GPs are looking to assess the overall ESG risk profile of their portfolio companies and identify high-level red flags for screening and engagement. These include company information found in adverse media, lawsuits, negative controversies, and reports by activist NGOs.

- Climate metrics and DEI KPIs: GPs want to understand the climate risk of their portfolios and require climate-related data points to measure performance. Similarly, they want to understand how companies are prepared to address workplace diversity and inclusion.

- Regulatory Compliance: With the Sustainable Finance Disclosure Regulation (SFDR), Corporate Sustainability Reporting Directive (CSRD), and EU Taxonomy for Sustainable Activities regulations coming into effect in Europe, LPs and GPs across the globe need to fulfill disclosure requirements. They want to assess SFDR alignment of their portfolio companies and generate content required for regular reports and stakeholder requests.

- Benchmarking: GPs want to benchmark their portfolios on various ESG topics. They need to be able to contextualize data to understand how a portfolio company’s performance compares to peers and industry standards. However, readily available ESG data is new to private markets and often not shared among industry participants. This makes it challenging for GPs to create benchmarks.

What can be done to address these data availability challenges?

With limited ESG disclosures available from private companies, GPs need to find alternative methods to address this challenge. These are some of the following steps we recommend GPs take in order to narrow the ESG data gap:

- Portfolio company engagement: GPs can have periodic engagement sessions with their portfolio companies to identify challenges related to data collection/reporting and provide support where needed.

- Integrating industry questionnaires: There are multiple ESG questionnaires available that have been designed to help GPs collect ESG data from their portfolio companies. These include the UNPRI PC-PE ESG factor map, the LSTA ESG borrower questionnaire, and the ILPA ESG assessment framework for LPs. GPs can leverage these questionnaires to streamline data collection across their portfolio companies and ensure uniform reporting.

- Collaborating with industry networks & peers and sharing best practices: GPs can engage and collaborate with other firms to address prevailing ESG data challenges. They can also partner with ESG data providers and industry initiatives to collect and benchmark portfolio company performance.

- Novata provides a standardized framework for private companies to report on key quantitative ESG metrics. This can further be utilized to develop custom ESG benchmarks and industry analyses.

- The ESG Data Convergence Initiative is an open partnership of private market stakeholders committed to streamlining the industry’s historically fragmented approach to collecting and reporting ESG data. Participating firms agree to report on a core set of ESG metrics that facilitates portfolio company benchmarking and increased transparency.

Conclusion

The scarcity of meaningful ESG data poses significant challenges for GPs aiming to integrate sustainability considerations. However, as we have seen, GPs can leverage the above-proposed recommendations to address these challenges through framework standardization, industry partnerships, and improved data collection methodologies. As the private sector continues to evolve, integrating ESG principles into investment decision-making becomes imperative for long-term success.