The ESG Conundrum

Opportunity Meets Complexity

Developing infrastructure projects in Africa is not for the faint-hearted. Between land rights, grid access, and community engagement, developers have a full plate of challenges. But here’s the good news: Africa’s capital project market is booming.

According to EY's Africa Attractiveness Report, in 2024 alone the continent attracted $162 billion in capital investment, a 135% increase over pre-pandemic levels. AVCA's 2024 African Private Capital Activity Report indicates that capital activity also surged, with $5.5 billion invested across 485 deals, marking the second-highest deal volume on record. Infrastructure and energy remain top targets.

With this influx of capital comes a higher bar for environmental and social governance. All African countries are classified as non-designated countries under the Equator Principles, meaning investors can’t rely on national regulatory systems alone to manage ESG risks. Instead, they turn to stricter international frameworks like the IFC Performance Standards and the Equator Principles to guide their due diligence and safeguard their investments.

High Standards, Early Costs

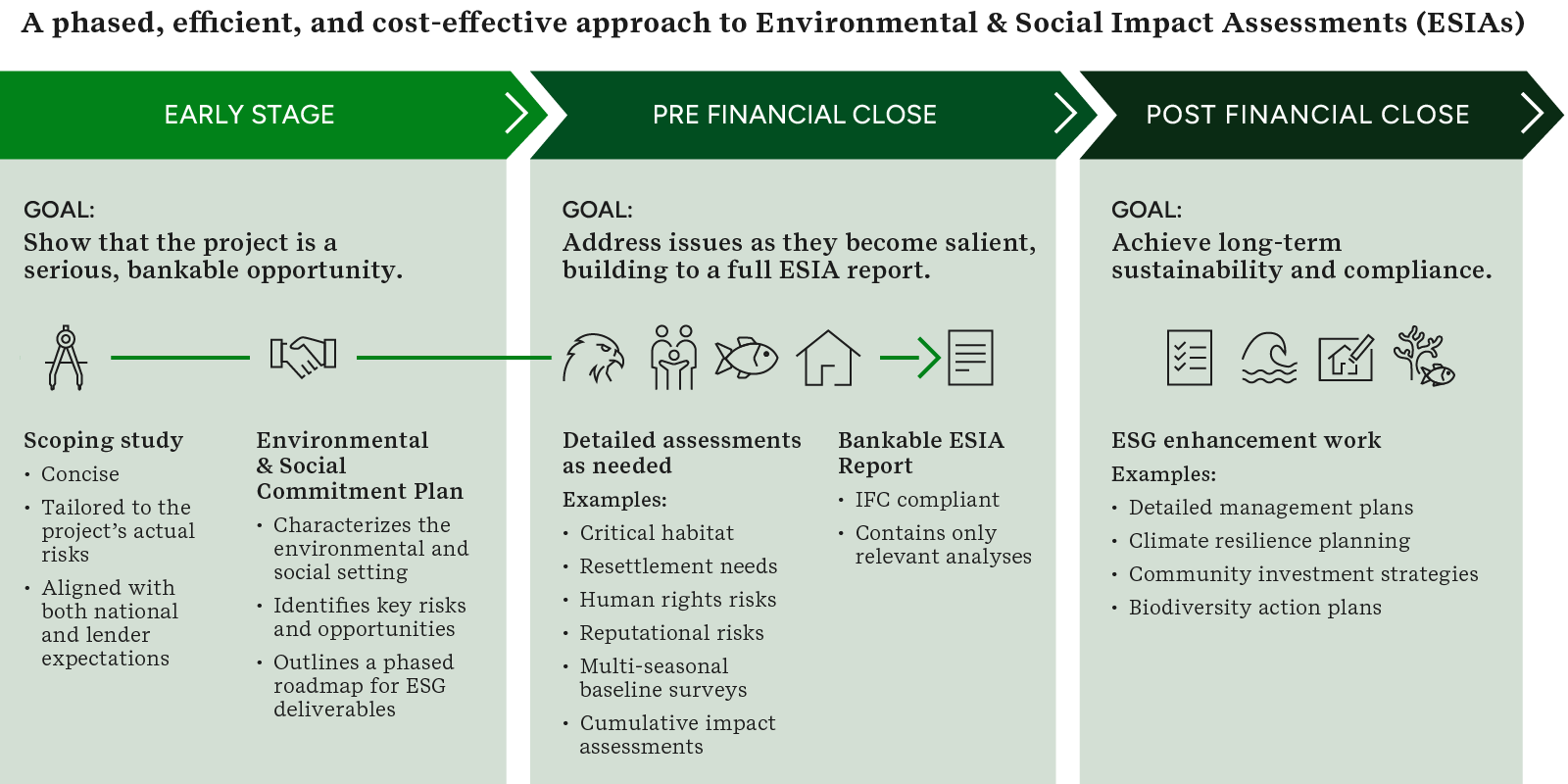

For developers, this creates a conundrum: how to meet these high ESG expectations without front-loading costs on projects that may still be in early feasibility stages. That’s where a smarter, phased ESG strategy comes in.

At the intersection of project development and finance, this ESG conundrum plays out time and again. On one hand, ticking the ESG boxes early can make your project more attractive to investors and lenders. On the other, front-loading these costs—before you even know if the project is viable—can feel like throwing good money after uncertainty.

Winning the Race to Financial Close with Smarter ESG

The competition for infrastructure finance in Africa is fierce. Only a small percentage of infrastructure projects on the continent reach financial close, often due to inadequate project preparation. In this environment, being ESG-ready isn’t just a “nice-to-have”—it’s a differentiator. Developers who can demonstrate a clear, credible ESG strategy are more likely to stand out in crowded pipelines, secure in-principle commitments faster, and move toward financial close ahead of the pack.

In many cases, developers do not “win” funding outright — they are simply better prepared, more aligned with investor expectations, and able to de-risk their projects earlier. That’s the edge a smart, phased ESG strategy can deliver.

So how do you strike the right balance?

Step 1: Start Smart—Plan Proportionally, Engage Strategically

Before any fieldwork begins or reports are drafted, the smartest move a developer can make is accurately defining project scope.

In the rush to get started, it’s easy for projects to launch with a request for an IFC-compliant Environmental and Social Impact Assessment (ESIA) that’s too broad—leading to unnecessary studies and inflated costs that don’t align with the actual risks or realities on the ground.

The good news: the IFC Performance Standards are clear—the level of environmental and social assessment should be proportionate to the nature, scale, and location of the project. A reservoir-based hydropower scheme? That’s going to be a major exercise. But a thermal plant in an existing industrial zone? That might only require a focused ESIA prioritizing the assessment of emissions, water use, and occupational health and safety.

Scoping is the watershed moment. It’s where developers can either set themselves up for a lean, efficient ESG process—or lock themselves into an expensive, over-engineered one.

That’s why Step 1 is to bring together your ESG advisors, early investors, and technical leads to develop a proportional scope of work tailored to the project’s actual risks and aligned with both national and lender expectations. This isn’t about cutting corners—it’s about cutting waste.

Step 2: Scale with Confidence—Align ESG Spend with Project Maturity

Once you’ve scoped your ESG requirements proportionately, the next challenge is timing—knowing when to invest in what. ESG is a strategic tool that should be used with precision.

At the early stages of project development, when feasibility is still being tested and capital is tight, developers need just enough ESG intelligence to demonstrate credibility, attract investor interest, and position the project as a serious, bankable opportunity.

A great starting point? A concise scoping study (as already alluded to), paired with an Environmental and Social Commitment Plan (ESCP). Framed against the IFC Performance Standards, this combo can:

- Characterize the project’s environmental and social setting

- Identify key risks and opportunities

- Outline a phased roadmap for ESG deliverables

This gives investors a clear signal: We understand ESG, we’re committed, and we have a plan.

As the project matures and investor interest deepens, certain ESG aspects start becoming more important. Investors may want clarity on:

- The presence of critical habitat

- The scale and nature of resettlement, and whether voluntary adherence to IFC standards is feasible

- Any human rights or reputational risks (often linked to legacy activities)

These issues can be prioritized for early assessment, while more detailed studies—like multi-seasonal baseline surveys or cumulative impact assessments—can be scheduled later as the project moves towards financial close.

The post-FC phase is where ESG enhancement work can be scheduled — things like:

- Detailed management plans

- Climate resilience planning

- Community investment strategies

- Biodiversity action plans

These aren’t typically deal-breakers at the investment stage, but they’re essential for long-term sustainability and compliance.

The key takeaway? Not all ESG deliverables are created equal or needed at once. By aligning ESG effort and cost with project confidence, developers can stay lean, stay credible, and stay in control.

Step 3: Build the Right Team—and Structure the Process Smartly

When it comes to the ESIA, independence is non-negotiable. Country authorities and responsible investors expect the assessment to be conducted by an external, impartial consultant.

This is where strategy meets structure.

In many African jurisdictions, developers must complete a national EIA to obtain environmental permits. At the same time, international financiers require a lender’s ESIA that’s aligned with global standards. While it can be efficient to combine the two in some instances, experience shows that treating them as separate but coordinated processes often delivers better outcomes.

The national EIA is handled by the local EIA consulting firm, while the lenders ESIA is scoped and managed separately by an international environmental consultant—but with alignment in mind. This approach allows for:

- Faster permitting from national authorities

- Cost-effective delivery by local firms without imposing international compliance burdens

- Strategic data collection that could be reused in the lenders ESIA

The key is for the national EIA to be managed proactively—design the scope, collaborate with the national consultants, and ensure that what’s done locally can be built upon for the lenders ESIA. This avoids duplication, saves money, and accelerates progress.

ESG as a Strategic Asset, Not a Sunk Cost

Environmental and social requirements from financiers aren’t going away—in fact, they’re only getting more rigorous. But that doesn’t mean developers need to front-load risk, cost, and complexity from day one.

By taking a strategic, phased approach—starting with a proportionate scope, scaling effort with project confidence, and structuring your ESG team and deliverables intelligently—you can turn ESG from a compliance burden into a competitive advantage.

ERM recently supported an investor by conducting a focused assessment on critical habitat and legacy resettlement issues associated with an infrastructure project in Cameroon.

This targeted study played a key role in securing the investor’s in-principle commitment to the project.