From the time the Australian Energy Market Operator (AEMO) released its first Integrated System Plan in 2018, governments and industry have focused on 2 main challenges associated with the buildout of renewables - the expansion of the physical network and system strength.

There is no doubt that the focus on network infrastructure has been appropriate given the long lead times to deliver, and much progress has been made, but are we running out of time? Today, with more coal generators approaching the end of their asset life, there is widespread concern for the security of supply. It is clear we need to pick up the pace of building wind, solar, storage and other fast response firming capacity to replace the aging coal fleet.

But the buildout of projects is not the only concern. Our financial energy markets must transform, as our coal-fired generators are also natural sellers of many electricity derivative contracts.

Why do financial electricity markets matter?

Retailers pay AEMO spot market prices for the electricity supplied to their customers. The 5-minute NEM spot market is extremely volatile, with prices ranging from -$1,000 to +$17,500 per MWh. Because electricity retailers offer fixed tariffs to most of their customers over a one-to-three-year period, they are exposed to significant market risk.

On top of that, many retailers are asset light. Large gentailers will also become asset light as their coal fired assets retire. In addition to their own assets or directly contracted generation, retailers rely on financial markets, mainly the ASX Energy Exchange to manage their risk exposure.

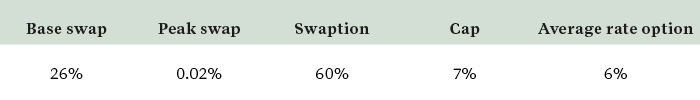

In Table 1 we see the main product categories traded on the ASX by volume (TWh) over FY2024. Coal generators are key actors in the swap and swaption markets, with flexible generation sources such as hydro-power, gas peaking plants and more recently storage dominating the cap and options markets.

Table 1: Share of ASX ENERGY EXchange traded products

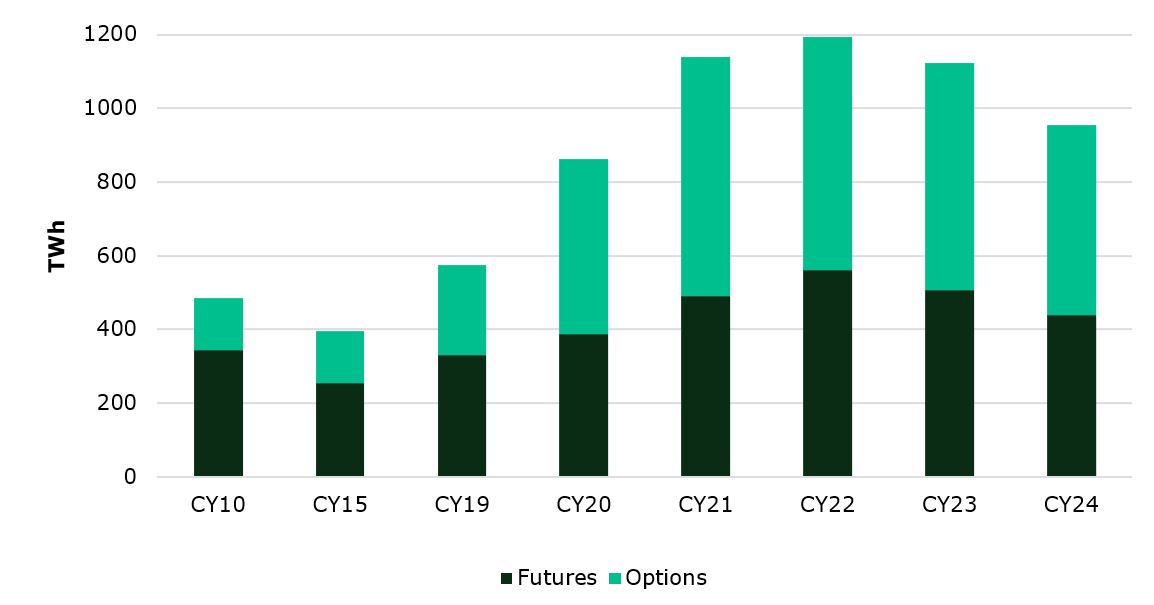

In the future we are likely to see greater reliance on such financial (and physical) instruments to hedge risks. Less dependable coal fired generation, more weather-dependent variable renewable energy (VRE), and weather sensitive customer loads contribute to volatile spot electricity markets. We saw this in the period leading up to and including 2022. In that year the volume traded on the ASX Energy Exchange was 689% of underlying power consumption in the NEM (a liquidity ratio of 6.9), declining year-on-year as illustrated in Figure 1 to reach 5.5 in 2024 (Note, this measures how liquid the contract market is by comparing traded volumes to the total volume of electricity demand in the NEM - excluding Tasmania which is not covered by instruments traded on the exchange).

Figure 1: Volume traded on the ASX Energy Exchange

Why is this so significant? Competition in the retail market and therefore the delivery of affordable electricity to businesses and households depends on a liquid financial market.

The 20% drop in the ASX Energy liquidity ratio since 2022 is therefore concerning.

While the market events of 2022 may have pushed some smaller retailers to the over-the- counter (OTC) market, this push is unlikely to have driven demand below 2021 levels.

The trend, in ERM1 view, is mainly driven by supply-side market dynamics.

Coal generators are significant suppliers of ASX Energy products. The problem of backing financial contracts with an aging fleet was well illustrated by the $1.3 billion loss reported by EnergyAustralia during the first 5 months of 2022 on electricity forward contracts. These losses were attributed to outages at the Yallourn power station in Victoria and coal supply constraints at its Mount Piper generator in NSW. The outcome was EnergyAustralia falling short on its committed contract positions.

To cover their short positions, EnergyAustralia incurred higher hedging costs at a time of very high spot prices as illustrated in Figure 2. Even if an old coal generator remains operational, its owners will decrease the portion of the plant contracted – removing the volume available from the ASX Energy Exchange well before the actual closure date.

Liquidity will decline further if the financial electricity markets continue to rely on coal fired power generators to supply the traditional products - such as baseload futures and forwards – that are commonly used by retailers to hedge their customer loads.

What is the size of the supply gap to fill?

Owners of ∼https://wattclarity.com.au/long-term-market-trends-and-forecasts/24% of the coal fired generation capacity in the National Electricity Market (NEM) have nominated their retirement within less than 4 years (by the end of 2028) on the basis that as these plants reach the end of their technical life, they will no longer be commercially viable and face major maintenance costs.

Increasing grid supplied renewable electricity from the current 39% contribution to meet the Australian Government’s renewables target of 82% by 2030 will further impact the viability of coal-fired generating units which are not designed for cycling and operating at low loads - bringing forward the scheduled retirement dates of a further 33% of coal generation capacity in the NEM (∼57% in total as modeled by ERM under our Plexos® based fast pace of transformation scenario). Unless, of course, the government steps in to extend the life of these generators as already witnessed with the Yallourn Power Station in Victoria and Eraring Power Station in NSW.

Given that ∼ 68% of the total NEM coal fleet will be older than 40 years by 2030, and that the average retirement of the last 6 large coal generators (Lidell, Hazelwood, Munmorah, Wallerawang C, Swanbank B and Northern Power Stations were all >500MW) was ∼42 years, sufficient renewable generation and fast response firming capacity needs to be built to replace this estimated 57% of coal generation by 2030.

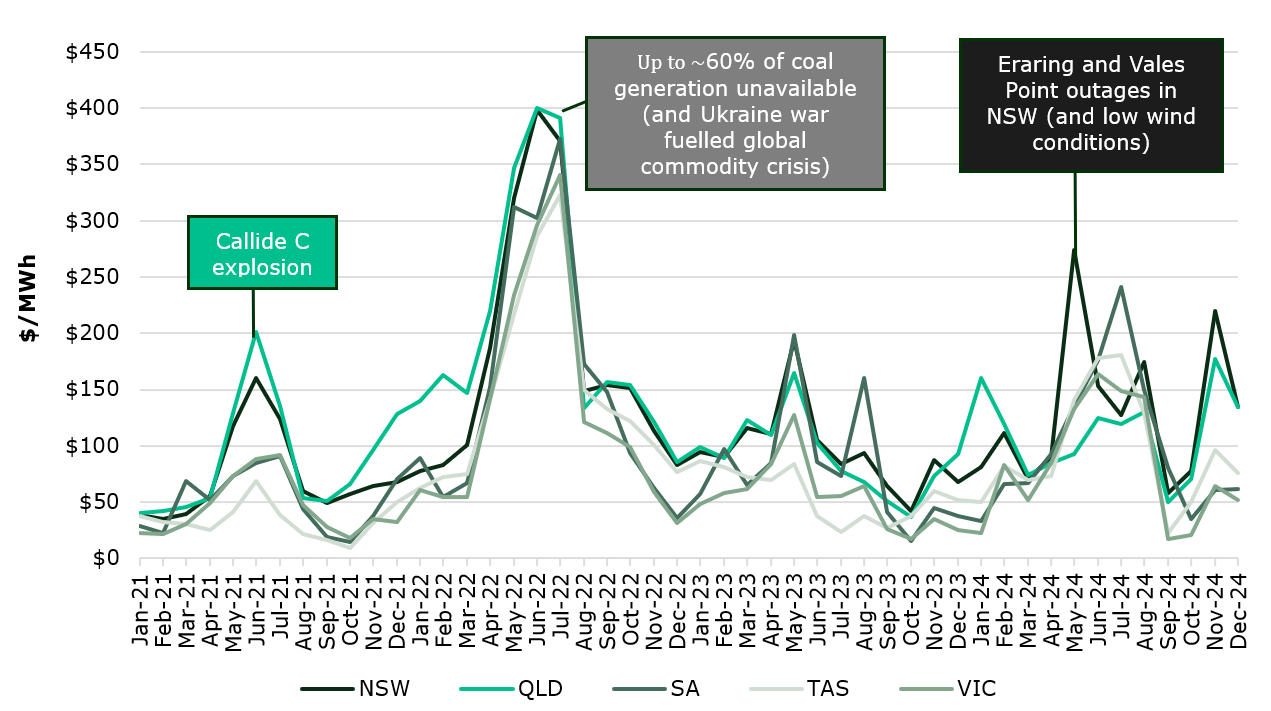

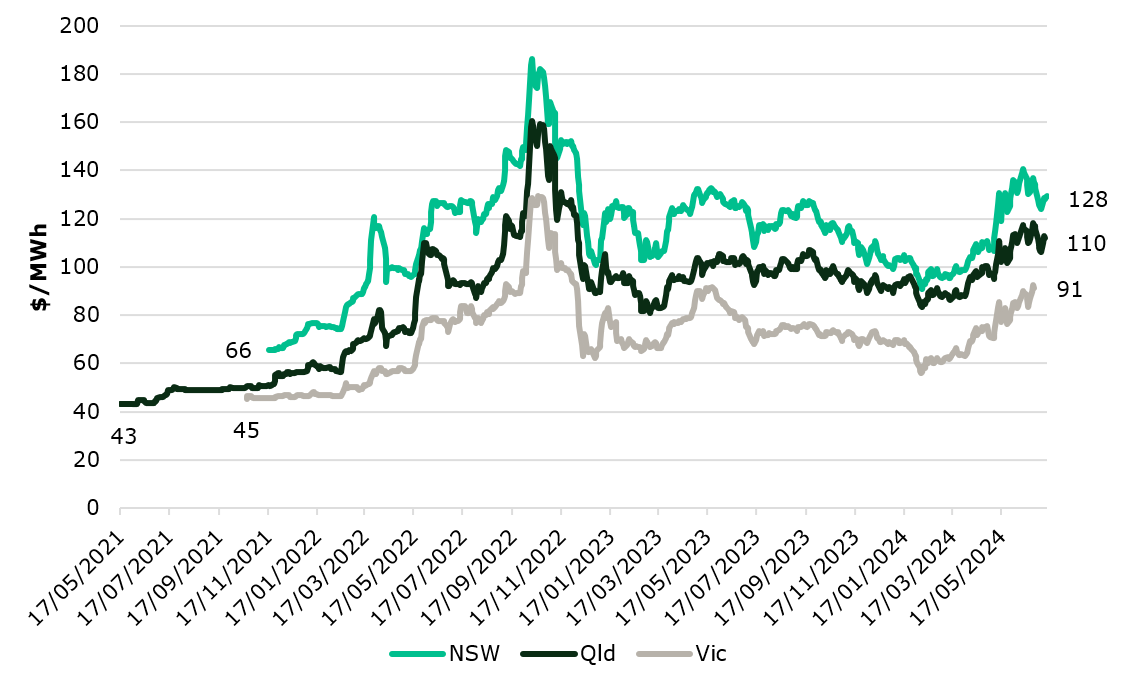

Failure to bridge this gap will jeopardize the security of supply as the risk of power disruptions grows. Furthermore, extreme spot market price events, as seen in Figure 2 below with reference to 2021, 2022 and 2023, increasingly coincide with coal-fired power generation outages as the coal fleet strains under operational changes to accommodate cycling – which leads to thermal fatigue, mechanical stresses and increased wear and tear.

Figure 2: Average Wholesale Electricity Spot Prices in the NEM

Unplanned outages of coal units are now the norm, contributing to the general decline in operating capacity assessed at 65% (as a percentage of nameplate capacity) in 2024 compared to the more than 80% expected from a well-performing coal fleet. The Coalition’s long-term plan for additional capacity through nuclear power generation aside, this poor reliability supports building new wind, solar and fast response firming capacity at pace.

Getting on with the job!

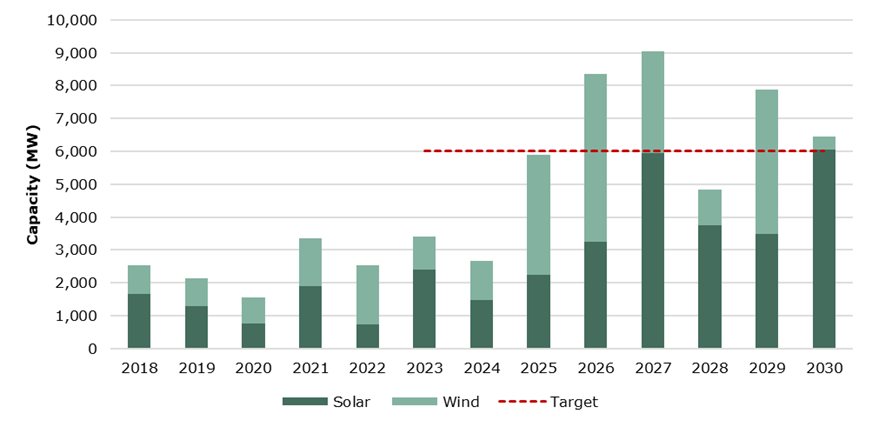

To meet the 82% renewables target by 2030, at least 6GW of large-scale VRE capacity must be added every year between FY23 and FY30 in the NEM. This is more than double the annual average of ~2.5GW of new utility-scale renewable capacity delivered between FY22 and FY24.

Figure 3: New capacity added and anticipated CY2025 to 20302

Whilst there is significant catching up to do, the forecast for the next few years is encouraging.

That said, we know delays are common and could disrupt the supply-demand balance, as based on ERM3 estimate in Figure 3, the 6GW annual new capacity target is only likely to be exceeded in 4 of the 8 years. Much of the shortfall in VRE buildout in recent years can be attributed to:

- network connection and commissioning delays

- delays in planning approvals and lack of community support

- high cost of capital driven by cost of debt and competition for equipment and skills.

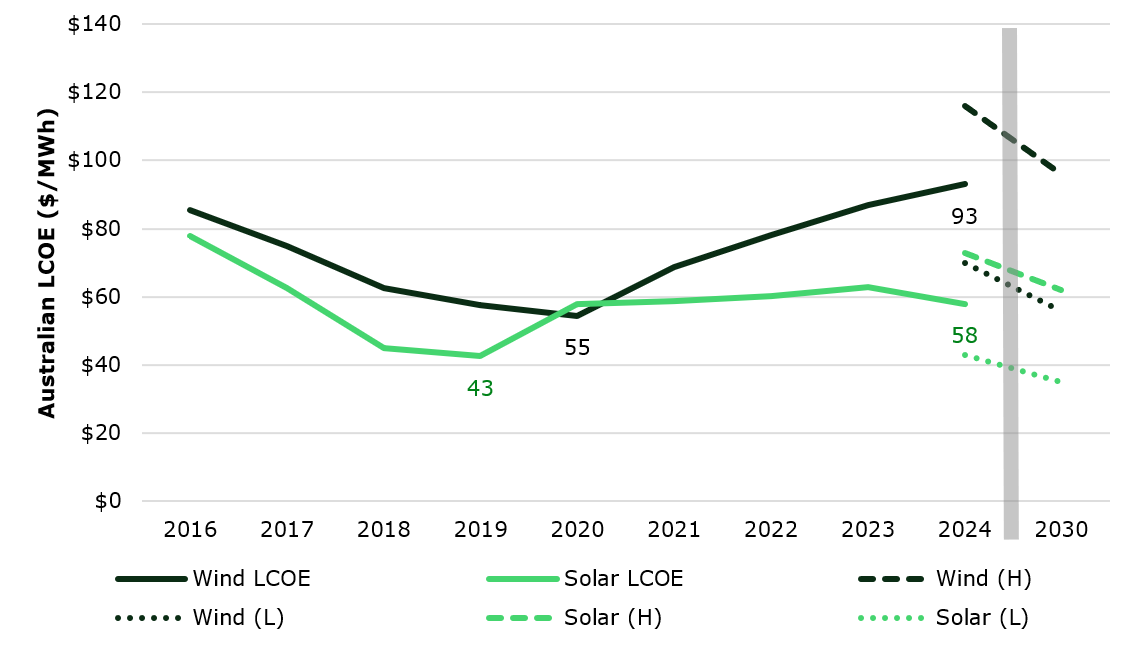

While the cost of solar power generation has moderated somewhat since 2020, the cost of wind power remains stubbornly high with significant uncertainty about the near-term trend, as illustrated in Figure 4.

Yet despite rising capital costs, firmed wind and solar power generation remain the most affordable sources of new electricity supply even when including the integration costs for storage, transmission and system security.

Figure 4: Evolution and forecast of solar and wind LCOE over time4

The increase in the Levelised Cost of Energy (LCOE) for renewable power generation in the case of wind of 69% since 2020, must also be viewed in context of the recently seen increase in futures market electricity prices. It is driven in part by an increase in commodity cost, as well as higher risk premiums due to price volatility, and the market perception of increased risk. As illustrated in Figure 5, baseload futures contract prices for FY2025 delivery have risen by between 94% and 156% across the key NEM states since 2022 when they first traded to when last traded in June/July 2024.

Figure 5: ASX FY2025 futures Trading history

What will revive Australia’s financial electricity markets?

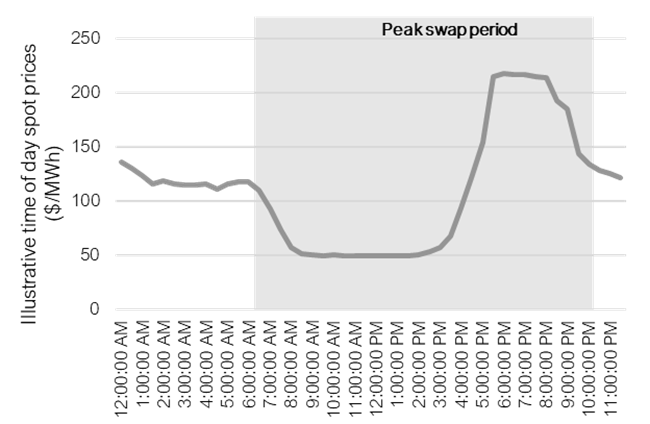

Retailers have been stuck for many years in the outdated peak- and off-peak period convention. As illustrated in Figure 6, the concept of peak (07:00am to 10:00pm Monday to Friday, excluding public holidays and any other days determined by ASX) and off-peak electricity tariffs have little relevance given the prices that are now typical during the middle of the day. Unsurprisingly, the ASX peak contract volume dropped below 1TWh per quarter in 2021 and declined steadily since then to virtually zero.

Figure 6: Average daily spot market price curve during the peak price period

The financial markets have also been slow to respond to the need for alternative hedging products that are more suited to increasingly asset-light retailers which have signed power purchase agreements (PPAs) with VRE projects. For these retailers, coupling solar PPAs with baseload futures or forward contracts could, in many cases, increase their market risk exposure.

Despite the waning interest in its peak contracts, it has taken the ASX Energy Exchange more than 4 years since the 2020 ARENA funded study into Super Peak Swap Contracts, Solar Shape Swap Contracts, Inverse Solar Shape Contracts and Virtual Storage Contracts to respond with new products, scheduled to become available in July 2025. The new Morning Peak Electricity Futures will cover the 6h00 to 9h00 period and the Morning Peak Electricity Futures Contract will cover the 16h00 to 21h00 period.

It is a start and provides a new channel to market for renewable energy and storage-owner operators for a product that is better suited to their capabilities than a base block - and more suitable for the evolving hedging structures targeted by retailers.

Importantly, it is not about replacing current products with identical futures market products. The hedge book of all retailers post-2028 will start to look very different to today’s.

A new class of suppliers is needed to provide innovative products suitable for managing risk in a volatile market where both loads and generation are weather sensitive.

Sophisticated renewable generation and storage asset owners that seize the opportunity can unlock significant premiums in the post 2028 world, but it will take at least 3 to 5 years to build the trading and risk management capabilities to thrive in this segment of the market.

Now is the time for renewable energy generators and storage operators to consider their role in the energy transition and the electricity derivatives market specifically, or risk being relegated to a lower tier of “as produced” generators, which will be an extremely price competitive segment as we approach 2030.

Key takeaways

- There are clear signals that the NEM is running out of time. We must get on with the job of building out wind, solar and fast response firming capacity to replace the aging coal fleet.

- Demand for financial derivatives will grow as market volatility increases and large retailers become asset light with the retirement of their coal generation fleets.

- Coal generators’ interest in backing financial products will diminish in line with the decline in their assets’ reliability and the growing risk of being short against contract positions.

- The market for financial electricity derivatives has received little attention and has been slow to evolve. This market can no longer be ignored. An efficient, affordable and competitive electricity retail market depends on it.

- Now is the time for renewable energy generators and storage operators to consider their role in the energy transition and the electricity derivatives market specifically, or risk being relegated to a lower tier of “as produced” generators, which will be an extremely price competitive segment as we approach 2030.

[1] This article was written when our team operated under the Energetics brand, before becoming part of ERM.

[2] ‘Anticipated’ includes projects in commissioning, committed and advanced stages. SOURCE: ERM Energetics’ proprietary database. Various sources including AEMO and developer websites.

[3] This article was written when our team operated under the Energetics brand, before becoming part of ERM.

[4] CSIRO GENCOST reports FY2018 to FY2030, noting 2016 to 2024 data points are based on mid-point of CSIRO high and low data points year.

Original article published in WattClarity

View all

View all