As Australia accelerates its transition to an electricity system powered by predominantly clean energy, new financial and operational risks are emerging. Many are not being managed effectively. While the physical energy transition infrastructure builds momentum, the financial products and systems that once helped energy users navigate price volatility are struggling to keep up. Coal power generation capacity closures are approaching fast, electricity financial market liquidity is declining, and traditional hedging tools are increasingly less suitable to manage new market risks. This is creating a perfect storm of compounding power market risks. Energy users, particularly those uncontracted through to 2030, need to act now to take control of their exposure to growing electricity market risks and energy costs.

DOWNLOAD THE REPORT1. Rising volatility and low market liquidity = growing electricity market risks

Australia’s electricity markets are becoming more volatile and less liquid. This amplifies risk premia, and cost to end users (linked to futures market prices). Volatility is fuelled by physical market dynamics and global commodity market disruptions. Prices are harder to predict, lower volumes are being traded on the ASX Energy exchange, and financial premiums are rising.

- Volatility is increasing in both near and medium-term prices, as weather driven events continue to impact supply (e.g. extended wind drought) and demand (e.g. extreme heat events driving cooling loads). This is being compounded by the reduced reliability of Australia’s ageing coal fired power generation fleet (discussed in section 2).

- Price distributions are becoming more skewed, with the impact of extreme spot price events lasting longer as illustrated in the figure below. This means energy users are not only facing more frequent spikes but also prolonged periods of high prices. Thus, presenting a growing risk to buyers on short term contracts looking for opportune windows in which to re-contract (i.e. increased time-to-market risks when compelled to renew contracts for multi-year periods when prices are at the crest of the wave).

- Liquidity in the financial electricity market is trending down. ASX Energy trading volumes have fallen 20% over the period 2022 to 2024. Consequently, asset light retailers face increasing headwinds to access cost competitive risk management products, risking reduced competitiveness in the retail electricity market should this trend persists. Reduced liquidity (and competitiveness) will ultimately lead to higher prices for all energy users.

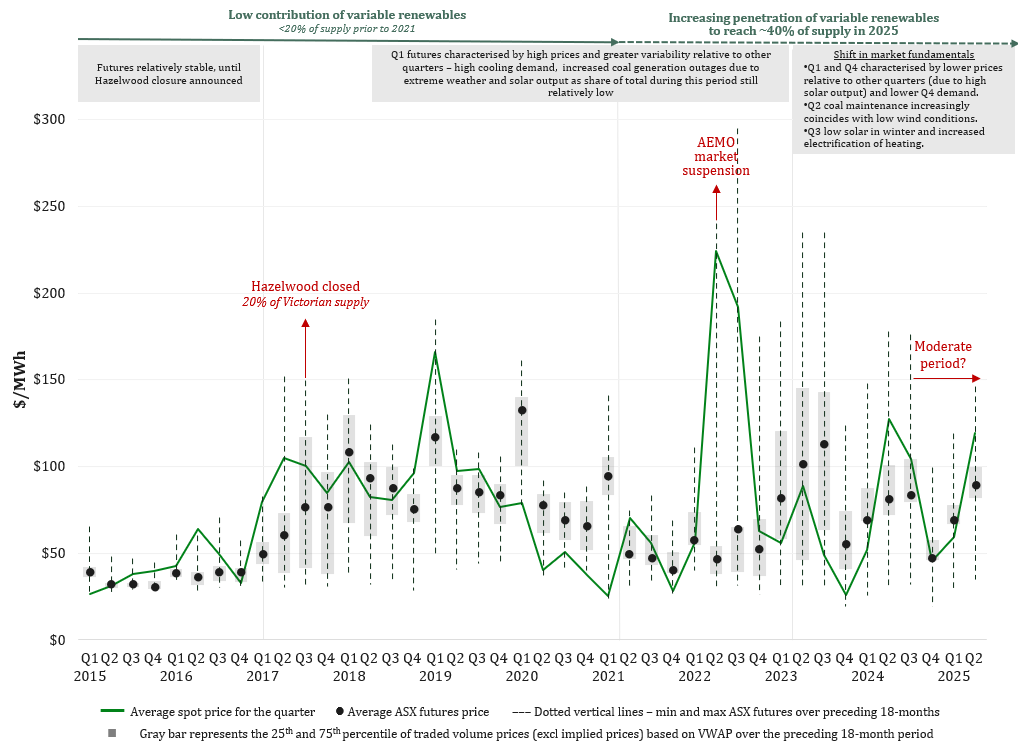

- Market risk premiums have surged, reflecting this increased perception of risk. Figure 1, using Victoria as an example, demonstrates that periods of elevated spot prices typically lead to an increase in the price at which sellers are prepared to sell baseload futures contracts, as well as a greater willingness among buyers to purchase hedges at higher prices. For instance, in 2022, several quarters experienced spot outcomes surpassing most baseload futures contract prices, which heightened the market's perception of risk. This resulted in increased average prices for baseload futures (exceeding spot outcomes) throughout 2023 and most of 2024. The same market response was observed when Hazelwood closed in Q2 2017, with the impact immediately evident on the spot market, while futures prices became increasingly volatile and ASX baseload prices still traded above spot in Q3 2018.

Figure 1: Volatility in baseload futures contract prices and comparison to spot price outcomes (Victoria) | Source: ASX and ERM Energetics

Figure 1: Volatility in baseload futures contract prices and comparison to spot price outcomes (Victoria) | Source: ASX and ERM Energetics

More recently, despite the high volatility of baseload futures contracts persisting, their average price has aligned more closely with the average spot price. Should this market dynamic persist, we can expect that instances of elevated electricity spot prices and volatility will once again have a significant and enduring impact on baseload futures contract prices. This is expected to result in prolonged periods marked by elevated price levels and fluctuations on the electricity financial market. Thus, increasing cost and time to market risk.

2. Australia’s energy risk blind spot: Ageing and retiring coal meets market unpreparedness

The vast majority of Australia’s remaining coal-fired generators are old, increasingly unreliable, and anticipated to retire within the next decade. However, the market is not yet ready for life without them. Expected retirements in 2027–28 could result in serious challenges for reliability and price stability. Those risks are already evident.

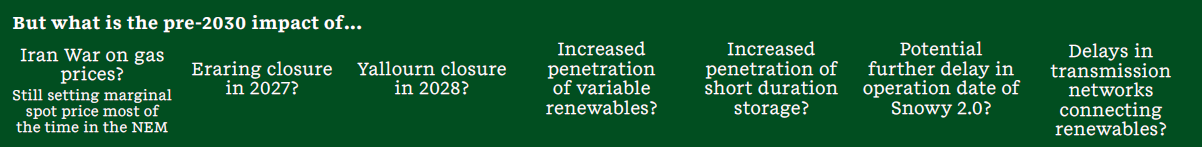

- Extending the life of old coal generators will further exacerbate reliability challenges, and therefore uncertainty of supply and price volatility. Currently, 60% of Australia’s remaining coal fleet is 40 years or older – with the average age of retirement of the last six coal power generators across the NEM being 42 years. Further capital investments could mitigate the risk of reduced reliability, but it is unlikely to be commercially sensible.

- Outages are increasing. With increasing penetration of low marginal cost variable renewable generation, coal fired power generators are pushed to operate their units at lower capacity in the middle of the day and ramp up dispatch at the end of the afternoon to benefit from high prices during the super peak period (i.e. late afternoon and early evening) when spot prices are typically highest. These cycling requirements are outside the original design specifications of these baseload coal fired power stations. Some of the newer coal generators have made investments to enhance their ramping capabilities, but for most old generators this mode of operation places significant strain on the plant and increases the risk of breakdowns.

Figure 2: Increased unavailability of coal generation capacity with age | Source: Neo Point and ERM Energetics

Figure 2: Increased unavailability of coal generation capacity with age | Source: Neo Point and ERM Energetics

- The value of firmed capacity is rising and so is the risk of inaction. Ultimately, with increased unavailability of coal generation, for energy users this means greater exposure to price volatility. In a market increasingly shaped by variable renewables, the ability to manage shape and volumetric risk – at both the supply and demand side – is increasingly critical.

3. Financial risk management: The missing piece of the energy transition

While Australia’s investment in renewable energy assets and the networks to connect them to the grid is accelerating, the electricity financial markets are lagging behind, and specifically the instruments required to manage this emerging supply landscape. So too is the expertise amongst suppliers of “electrons” (increasingly renewable generators). Without smarter approaches, this mismatch will become a growing source of electricity budget instability for energy users.

- Gentailers are shedding generation assets that underpinned the dominant hedging product (i.e. base blocks) traded on the ASX Energy exchange. As major retailers become asset-light, risk is shifting downstream to energy users. This trend is amplified due to reduced liquidity on the ASX Energy exchange (as outlined in section 1). Consequently, fewer suppliers will be able to provide firm pricing – even over the short and medium term. And those that can, will have greater pricing power.

- Traditional hedging products are increasingly unsuitable for the emerging market. Traditional base blocks are not suitable to mitigate the shape risk and variability associated with weather dependent renewables.

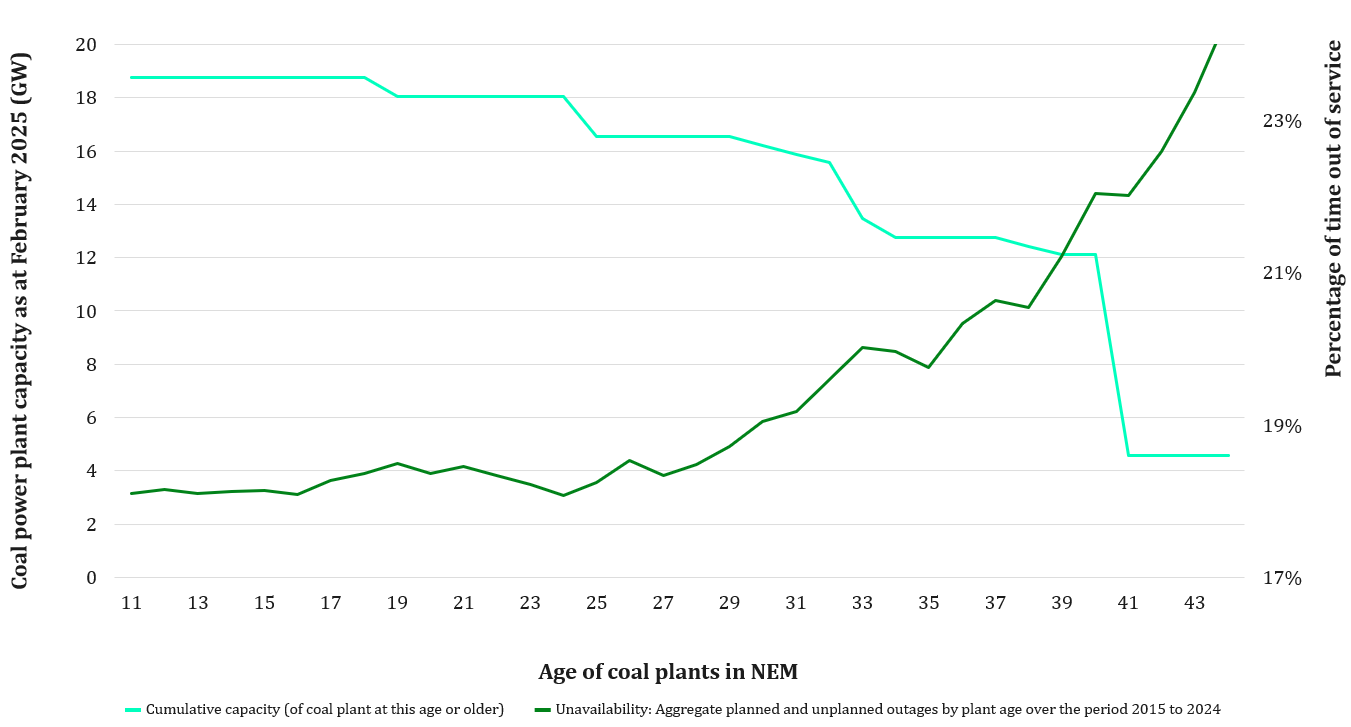

- Financial markets have been slow to respond – but new opportunities are emerging. The launch on the ASX Energy exchange of new morning and evening peak products is welcomed. However, this comes four years after the 2020 ARENA funded study into ‘super peak’ swap contracts, ‘solar shape’ swap contracts, ‘inverse solar shape’ contracts and ‘virtual storage’ contracts (see description below). In addition, as illustrated in figure 3, NEM demand in the middle of the day has been consistently falling for nearly a decade.

Figure 3: New Australian Peak Load Electricity Futures Contracts better align with periods of high operational demand | Source: ASX Energy and ERM Energetics

- Many large energy users have become complacent about managing their energy risks, incorrectly feeling they have no control, trusting that government will deliver a “smooth” transition and/or unrealistically expecting their electricity retailer will absorb the electricity transition risk at current premia. However, the introduction of new peak products by the ASX Energy exchange provides an exchange traded platform to suppliers of premium (albeit black) products better suited to renewables backed portfolios. Consequently, providing one of the key building blocks required by asset light retailers and energy intensive businesses to complement existing financial power purchase agreements (PPAs) / renewable centric hedge books.

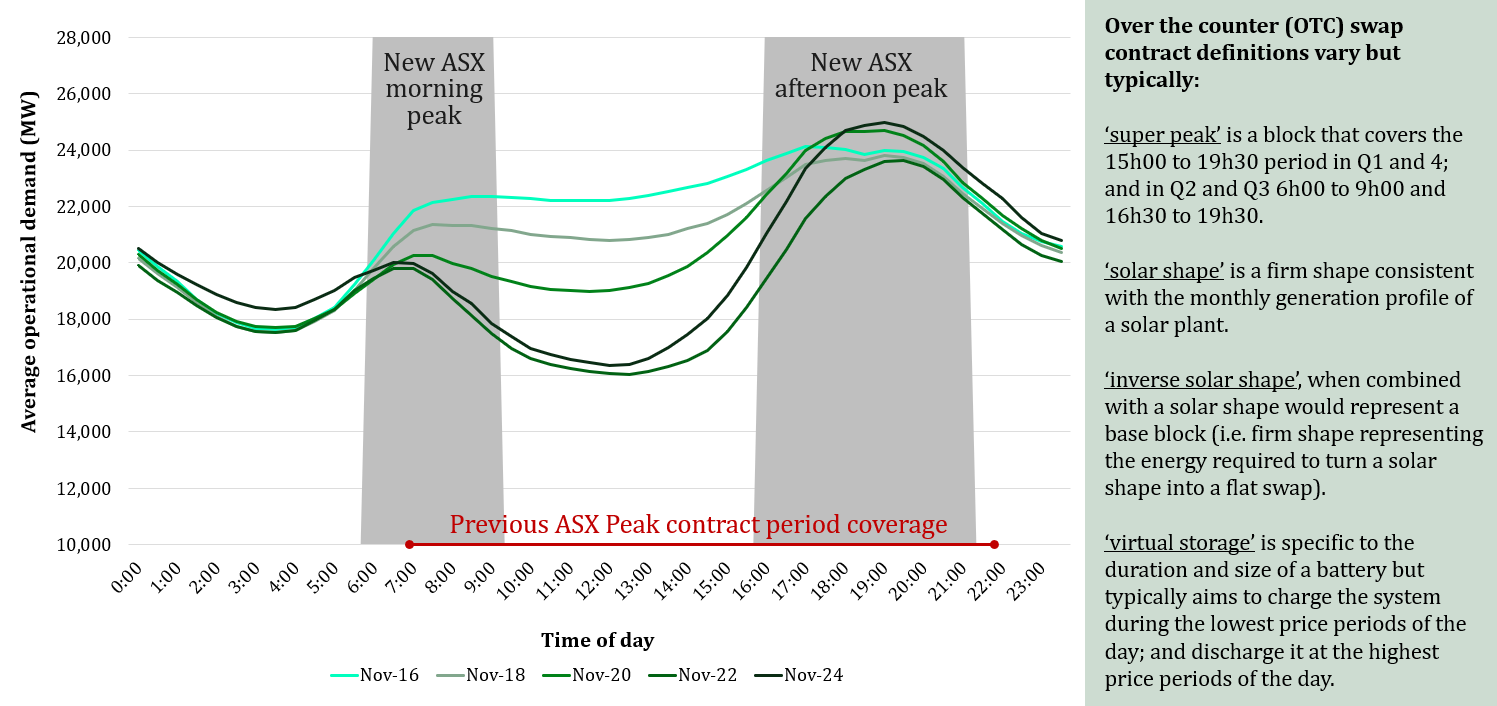

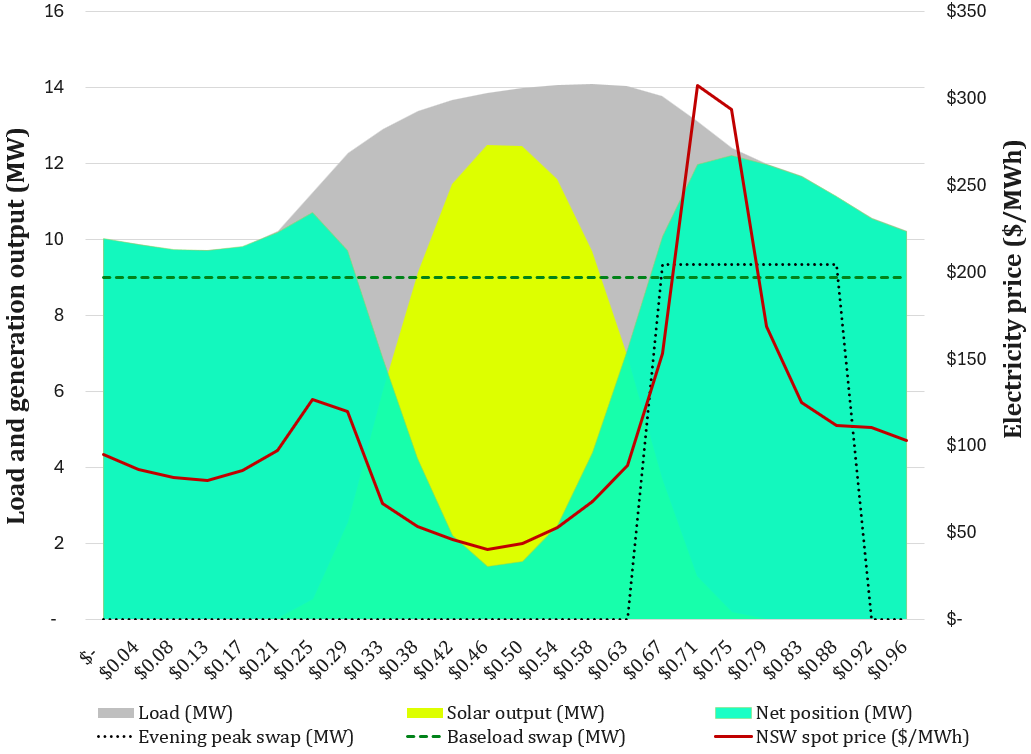

Figure 4: Illustrative net load position and spot price coincidence | SOURCE: ERM Energetics

This chart illustrates the net position, in green, resulting from a load exposed to the electricity spot market being partially hedged by the output from a solar farm. A high residual net position aligns with elevated spot prices during the early morning hours (notably in winter) and in the late afternoon hours (both summer and winter). Purchasing a 24-hour baseload swap contract is not a cost-effective hedging strategy as the spot price outcome in the middle of the day is much lower than the price of such baseload contract. An alternative, more targeted approach, is to purchase products that specifically aim to cover the early morning and late afternoon spot exposure such as an evening peak swap.

| We are in the midst of a structural shift in the energy market and therefore the market dynamics that people are used to are changing very rapidly. If you want to reduce your exposure to volatility in pricing and budget, if you want to reduce your overall electricity costs, you need to start taking control. New ASX Energy exchange products represent a critical step forward in aligning financial instruments with the realities of a high-renewables electricity system, high-volatility energy market, but only if corporates act to incorporate them into smarter, more staged procurement and hedging strategies. |

4. Navigating growing electricity market risks

The risks in Australia’s electricity markets are significant and growing, but they can be managed.

For Australian businesses and energy users, it’s about assessing your options against the growing cost of inaction during this transformational energy transition.

Risk premiums are expected to rise due to increased variable renewables and reduced firm capacity in the NEM, amplified by uncertainty around coal closures in 2027–28, increased unexpected unavailability of the remaining ageing coal capacity as well as the risk of delay in the timing of new infrastructure.

| If you're uncontracted through to 2030 and possibly beyond, you must act now or risk a future where you will be forced to recontract for supply amid heightened uncertainty and volatility. |

This period calls for immediate action to manage risks but also offers an opportunity to take greater control of your long-term energy strategy – and costs.

Diversifying your approach, through a combination of long-term hedges linked to renewable projects (supporting 2030 renewable electricity goals), and short-term market-linked hedges, can help mitigate the impact of price volatility and the uncertain capital cost of new infrastructure.

For users with loads exceeding 100GWh annually, now may be the time to take direct control of your hedging structure and shape your own path through the energy transition.

How ERM can help Australia’s largest energy users navigate the energy transition and manage energy market risks?

ERM can derisk your energy contracting strategy. Our team has advised some of Australia’s largest corporates to develop tailored strategies to support long term risk management in the power and renewable energy certificate markets. For investors, we leverage our knowledge of market dynamics and our quantitative risk analytics to advise on targeting and derisking investments. We are the renewable energy transaction manager and commercial risk advisors to Tomago Aluminium, NSW’s largest electricity user. We have also supported corporate renewable PPAs equivalent to ~ 25% of the volume contracted in the NEM between 2017 and the end of 2024, and actively manage a portfolio of 3.5TWh of annual electricity volume through active progressive purchasing.

Key questions for large energy users:

- Does electricity cost present a material expense to your business?

- Are you contracted for the period 2027 to 2030 (and possibly beyond)?

- Do you have an existing financial power purchase agreement with a renewable electricity generator?

- Do you have a renewable electricity target, but unsure whether now is a good time to contract?

If your answer is yes to any of the questions above, and you want to mitigate your energy transition risk exposure, please reach out if you have any questions or would like advice via AustraliaMarketing@erm.com or directly to Gilles Walgenwitz and Anita Stadler.

View all

View all