Australia’s new sustainability reporting standard, AASB S2 Climate-related Disclosures, is now in force, marking a significant shift in how organisations must assess and communicate climate-related risks. For many organisations, the biggest step change will not be building the narrative on climate risks and opportunities, but rather the requirement of quantifying the financial impacts, and linking them directly to financial statements. This shift moves climate disclosure from a sustainability exercise to a core financial reporting obligation – one that demands cross-functional collaboration and robust methodologies.

This article reflects on our market observations and client experiences and unpacks what quantification and materiality mean under AASB S2, and what reporters need to do in practice to comply.

Why does financial quantification matter?

Under AASB S2, climate-related disclosures must go beyond qualitative discussion. Entities are expected to:

- Quantify the financial effects of material climate-related risks and opportunities on revenues, expenses, assets, liabilities, and capital allocation

- Demonstrate how climate-related assumptions affect key line items, such as impairments, provisions, useful lives, and fair value measures.

In other words, climate is no longer a separate sustainability narrative. It is part of the core financial story of the organisation.

Materiality: What needs to be quantified?

The materiality test under AASB S2 mirrors that of financial reporting as entities are required to disclose information that could influence investor decisions, which means reporters must assess:

- Which climate-related risks or opportunities could have a material financial effect on the business model, strategy, or even cash flows?

- Are these impacts quantifiable now, or is only qualitative disclosure possible until data matures?

- Do current disclosures align with the material risks already recognised in financial statements (eg, impairments, provisions, capex commitments)?

Under AASB S2, reporters are required to “disclose material information about the climate-related risks or opportunities that could reasonably be expected to affect the entity’s prospects”1. On this front, AASB S2 aligns with the ISSB/IFRS definition “information is material if omitting, misstating, or obscuring it could influence decisions that users of general-purpose financial reports make”. This includes current impacts as well as reasonably expected future impacts, meaning forward-looking judgment needs to be considered.

Our observations are that some reporters are challenged with respect to “materiality judgements”, noting that auditors are likely to want to see not just what has been disclosed but the rationale for the exclusion of certain risks. As such, reporters do need to disclose how they arrived at their “thresholds” and why certain risks are deemed immaterial.

If a risk is material, quantitative disclosure (even ranges or sensitivity analysis) is encouraged as it is more useful to investors, noting the “without undue cost or effort” provisions within AASB S2, which considers the lack of appropriate skills or resources to provide quantitative information relating to the financial impacts of a climate-related risk or opportunity. To that end, where organisations elect not to quantify in year 1 of disclosure, they should be planning how to mature their capability to report over time.

Scenario analysis: from narrative to numbers

- Scenario analysis is at the heart of AASB S2. Entities must disclose:

- Which scenarios were used (eg. 1.5°C, >2.5°C pathways).

- Assumptions and parameters underpinning these scenarios, including carbon prices, demand trajectories, and physical risk data.

- The quantified resilience of the organisation, showing how financial position, performance and cash flows might shift under different futures (short-, medium- and long-term horizons)2.

For many reporters, this will mean translating scenario modelling into tangible financial impacts such as:

- Asset impairments under a net-zero transition.

- Increases in insurance premiums or operating costs resulting from physical risks.

- Shifts in revenue due to changing demand for carbon-intensive products.

- Capital expenditure required to fund transition initiatives.

Financial quantification: what is challenging reporters?

Perhaps the most challenging requirement is the explicit link to financial statements. AASB S2 expects reporters to highlight where climate-related assumptions have influenced or are anticipated to influence, including:

- Asset valuations and impairments

- Useful life estimates and depreciation

- Provisions for decommissioning or litigation

- Contingent liabilities and ongoing concern assessments.

We are seeing the availability of climate data as well as availability of internal data likely required for quantification of impacts, as well as complexities of methodology, hinder the progress of financial quantification of climate risks across many organisations. The nuances of financial quantification of climate risks warrants finance and sustainability teams working hand in hand.

Financial quantification: where to start?

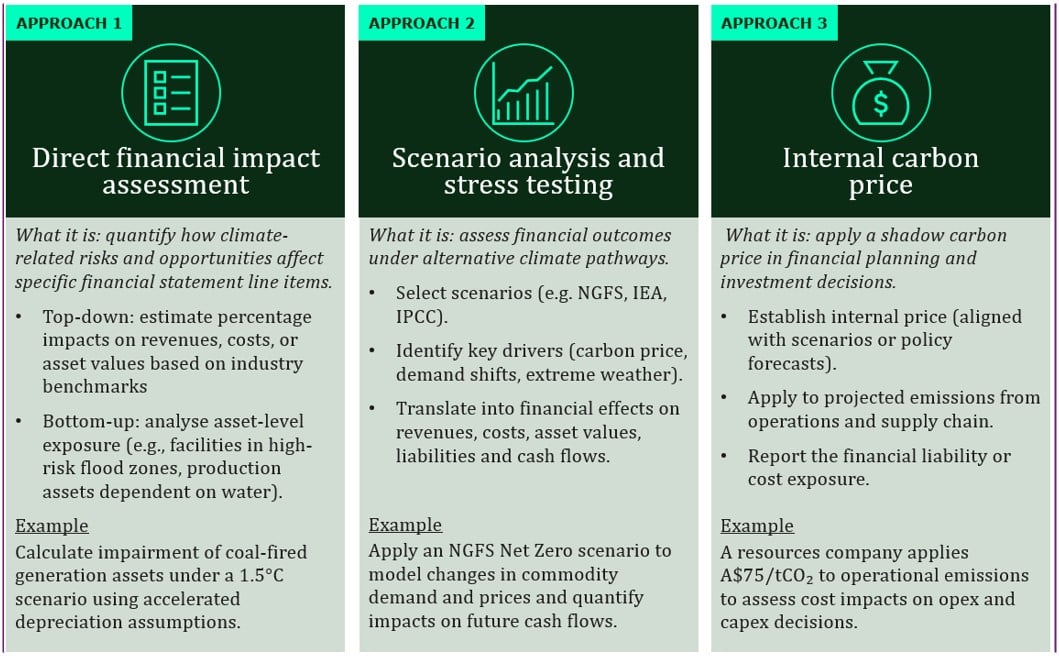

There is no one method that fits all when it comes to financial quantification of climate risks as illustrated in Figure 1, there are different approaches that can be considered and tailored to your specific data sets and situation. Whilst there are ‘off the shelf’ models, there are risks arising from their application, including lack of audit trail, challenges with data quality and relevance issues, and lack of robustness/flexibility. AASB S2 requires that climate risk quantification is explainable, decision-useful, and linked back to financial statements, which is something a black-box approach struggles to deliver.

Ultimately, complying with AASB S2 is more than a reporting exercise - it requires embedding quantitative climate risk assessment into the business fabric. In supporting our clients on their path to being disclosure ready we are applying a practical/foundational approach, including:

1. Selecting risks to quantify: Choosing which risks to quantify is not only about materiality. Organisations must also weigh the availability and quality of climate data, the internal data required to support quantification, and the complexity of methodologies (eg. whether probabilities can realistically be assigned to key risk drivers). Where the data isn’t available, organisations should be prepared to give users of the financial statements information that will help them understand the materiality of the excluded risk or opportunity, and would be advised to consider how the quantification could be refined for future years.

2. Building the quantification workflow: A clear workflow is the foundation for effective financial quantification. Organisations typically face two routes:

- Integrate climate considerations into existing financial models, embedding risk drivers into familiar processes and clearly stepping out the link between climate-related drivers, operational outcomes, and the financial results.

- Develop standalone climate-financial models, which may offer greater flexibility but require new governance structures and potentially additional resources.

3. From climate data to financial impacts: Once risk drivers are defined, model selection must account for factors such as spatial and temporal resolution. Translating climate risks into financial impacts requires choosing appropriate financial metrics (eg. cash flow, asset value, provisions, etc) and setting guardrails on what can reasonably be quantified. This should be a collaborative process between sustainability and finance, with a constant eye on where the impacts connect back to the financial statements.

Figure 1: illustration of potential approaches to financial quantification of climate risk

What should reporters do now?

To prepare for AASB S2 reporting, entities would benefit from:

- Mapping financial exposure: Identify which line items could be materially affected by climate risks and opportunities.

- Developing a quantification approach: Prioritise risks and opportunities that are measurable now, with a roadmap for improving data over time.

- Building scenario analysis capability (or seeking external/technical support): Ensure climate scenarios can generate financially meaningful outputs.

- Engaging the finance function early: Align sustainability disclosures with accounting judgements and assumptions.

- Disclosing transparently: Where impacts are not yet quantifiable, explain why and outline plans to improve.

ERM is here to help

AASB S2 shifts climate reporting from a narrative exercise to a financial disclosure regime. For Australian reporters, success will depend on showing investors not just what the risks are, but how big they are, and where they show up in the financials. Getting this right means embedding climate into core reporting processes and building confidence internally, with the auditors and with investors, that disclosures are robust, material, and decision-useful.

ERM emphasises that climate scenario analysis should serve as a practical tool for translating climate risks and opportunities into financial terms, such as future impact on cash flows, cost of capital, or total value at risk. The process relies on business-specific models and cross-functional engagement to develop robust, evidence-based assumptions for quantification3.

Our experience tells us that financial quantification requirements for climate risks is less about producing a single number and more about building a robust, iterative process. Success depends on adopting fit-for-purpose methodologies, engaging a cross-functional group (eg. sustainability, finance, risk, strategy and procurement), with outputs embedded in decision-making and financial statements rather than siloed in sustainability reports. Further, quantification should be transparent, supported by sensitivity and uncertainty analysis, and expressed as ranges rather than with false precision4. This should be complemented by qualitative narratives as exemplified by Telstra in its latest annual report5. Ultimately, organisations must treat financial quantification as an ongoing capability building process, aligning climate disclosures with core financial reporting to meet both regulatory expectations and investor scrutiny.

Globally, we have been supporting our clients with their climate disclosure requirements, across a range of voluntary and mandatory regimes (eg. IFRS and CSRD). We are leveraging this experience in working with our Australian clients to enhance their preparedness for their upcoming AASB S2 reports.

1 Climate scenario analysis - a guide for finance professionals

2 From Mandate to Mastery: Delivering on financial quantification requirements

View all

View all