Every September, in conjunction with the United Nations General Assembly, New York City hosts the world’s largest gathering of climate leaders, experts, and activists for Climate Week. Over the course of a week of events and conversations, attendees from the worlds of corporate sustainability, NGOs, academia, finance, and government come together to forge connections and share new solutions to climate challenges.

During this year’s Climate Week, the SustainAbility Institute by ERM, the Natural Climate Solutions Alliance (NCSA), and the World Business Council for Sustainable Development (WBCSD) launched Natural Climate Solutions and the Voluntary Carbon Market: A Guide for C-Suite Executives, which outlines how c-suite decision makers can use high-quality Natural Climate Solutions (NCS) voluntary carbon credits to counterbalance their unabated greenhouse gas (GHG) emissions.

NCS Address the Intertwined Climate and Nature Crises

The guide comes at a critical moment in the fight against climate change and nature loss given the significant economic risk that both issues pose. For climate change, global gross domestic product (GDP) could be 11-14 percent lower if temperatures were to rise by up to 2.6°C by mid-century in comparison to 0°C. Similarly, the collapse of ecosystem services such as pollination and marine fisheries could potentially further reduce global GDP by 2.3 percent annually.

Companies must dramatically step up their efforts to mitigate both crises. Natural Climate Solutions, which are Nature-based Solutions that address climate change, present an opportunity for simultaneous mitigation by removing and storing carbon from the atmosphere and protecting, sustainably managing, and restoring natural systems.

NCS’ potential to remove over 100 gigatons of the 810 gigatons of CO2 estimated to be required to stay on a below 1.5°C pathway make them effective climate action tools. Further, they are the only emissions reduction solution currently available at scale, and they are considerably cheaper than the limited mechanical carbon capture technologies currently available.

In addition to their climate benefits, high-quality NCS deliver biodiversity gains and provide socioeconomic benefits for local communities and Indigenous Peoples. For example, the NCSA’s eight NCS Lighthouses, which serve as world-class examples of high-quality NCS, have generated numerous positive impacts beyond climate. These benefits include protecting the habitats of endangered species, supporting local businesses and sustainable livelihoods, and enabling community development.

Investing in NCS Credits Is Good Business

Investing in NCS is not only the right thing to do given the nature and climate crises – it is good business.

First, companies can reduce their exposure to long-term risks from climate change and nature, while also unlocking new commercial opportunities. Second, by demonstrating their commitment to the climate and broader environment, they are likely to build stronger relationships with their stakeholders and increase employee satisfaction. A third benefit is that NCS are lower cost than other carbon removal strategies. By investing in them early, companies will be able to establish themselves in the market and secure a supply of high-quality projects.

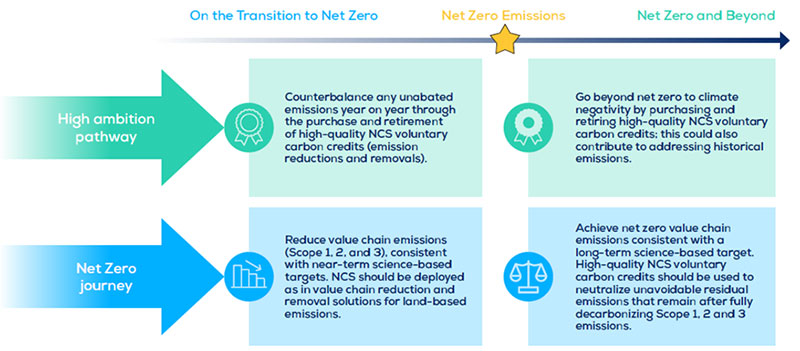

The climate crisis requires businesses to demonstrate leadership by counterbalancing their unabated emissions year on year, in addition to their efforts to decarbonize their value chain (Scope 1, 2, and 3 emissions) in the transition to net zero, through the purchase and retirement of high-quality carbon NCS credits on the voluntary carbon market.

Decarbonization of value chain (Scope 1, 2, and 3) emissions should be the main priority for all companies. In addition to value chain decarbonization, the guide recommends that companies pursue a high ambition pathway by purchasing and retiring high-quality NCS voluntary carbon credits to counterbalance any unabated value chain GHG emissions year-on-year while transitioning to net zero. Importantly, these credits should not be used in lieu of or delay the emissions reductions necessary to achieve net zero.

Once an organization achieves net zero, the guide recommends companies use high-quality NCS voluntary carbon credits to neutralize any unavoidable residual emissions and to go above and beyond net zero by using credits to counterbalance historical GHG emissions.

Achieving Net Zero with Natural Climate Solutions

2022 Climate Week Executive Roundtable Recognized the High Potential of NCS

Coinciding with the launch of the guide, ERM, NCSA, WBCSD, and private equity firm KKR organized an executive roundtable on September 22nd during Climate Week involving over 40 participants from businesses and non-governmental organizations. The roundtable focused on the need for businesses to pursue ambitious value chain decarbonization supported by the compensation of unabated emissions with high-quality NCS voluntary carbon credits.

Given the global impact of unabated climate change, participants lauded NCS’ climate mitigation potential as a key piece of the climate action puzzle. Participants also noted NCS’ centrality to achieving the decarbonization of the global economy needed in the next decade to remain on a 1.5°C pathway. Given that decarbonization will take time for most sectors, NCS’ ability to help accelerate decarbonization today by counterbalancing unabated emissions as businesses work toward net zero was seen as key.

NCS’ benefits beyond climate — such as the protection of biodiversity and the supporting of local jobs — were viewed as very important as well. Many participants also noted the world economy’s dependency on natural capital as a reason why aggressive action through NCS is needed to stem worldwide declines in biodiversity. NCS’ connections to nature and people were seen as a way to increase buy-in while avoiding the political polarization that surrounds climate change (in particular in the US), because issues such as improving water quality and creating job opportunities are more broadly supported.

While participants viewed NCS as strong tools in their climate action arsenal, they also recognized challenges that stand in the way of wider adoption of NCS. They mentioned worries about being singled-out for greenwashing and concern that their use of NCS credits might be interpreted as avoiding doing the challenging work of decarbonizing their value chains. They also expressed a need for defined standards for the voluntary carbon market to help reduce complexities that make it difficult to identify high-quality projects.

Though vitally important, NCS’ supply and demand are not yet at the level required to avoid climate and biodiversity tipping points and support local populations. According to the United Nations Environment Programme, only $133 billion is invested in NCS per year, much less than the $536 billion estimated to be necessary.

To create a demand pipeline for NCS, the NSCA encourages participants to procure their own high-quality NCS voluntary carbon credits. They are also encouraged to join the NCSA itself, which unites the voices of businesses, NGOs, and solutions providers to mobilize demand for high-quality NCS, and to participate in its NCS Investment Accelerator, a multi-stakeholder initiative to scale investment in NCS voluntary carbon credits.

During the roundtable, Tom Reichert, CEO of ERM, announced that ERM, already an NCSA member, would join the NCS Investment Accelerator as part of its commitment to address the world’s interrelated climate, nature, and livelihood challenges.

ERM has joined the NCS Alliance and signed up to the NCS Investment Accelerator as part of our own commitment to addressing climate, nature and livelihood challenges within our overall decarbonization strategy. We believe that high-quality NCS carbon credits make good business sense, and we look forward to working with peers, partners and clients to help drive this market forward.

A Critical Moment for Climate, Nature, and People

Companies have an essential role to play at this critical moment for climate, nature, and people. As our guide for C-Suite Executives and the New York executive roundtable demonstrate, NCS have a unique ability to benefit all three by mitigating emissions, protecting natural capital, and improving livelihoods. However, NCS demand is far below the level required to reduce the world’s exposure to climate- and nature-related risks. If companies are to do their part, they must act now to help scale demand by incorporating high-quality NCS voluntary carbon credits into their climate strategies