The new EU Carbon Border Adjustment Mechanism (CBAM) is not just a compliance issue but also an excellent opportunity for companies to create value and boost their decarbonization strategy. To get there, companies must get ahead of the curve, involve many functions within their organization, and, most importantly, make a solid plan. A five-step process can help companies understand and comply with CBAM and gain a competitive advantage by proactively leveraging its full implementation.

This is the second of two articles on CBAM. Please click here for the first article, explaining in detail how the CBAM implementation process works.

The main aim of the CBAM is to tackle climate change through the prevention of carbon leakage, and it is widely seen as a game changer as the EU ramps up its internal carbon pricing through the EU Emission Trading Scheme (EU ETS). This article outlines a 5-step process to help your company prepare for and strategically leverage CBAM. We will illustrate the potential value of taking action through a simple case study.

Ramping up the pressure

CBAM, which kicked off in 2023, currently covers a limited group of sectors but will quickly expand its reach. The initial group includes carbon-intensive industries deemed most at risk of moving production from the EU to regions with less stringent carbon regulation, also known as carbon leakage. The current sectors subject to CBAM are iron and steel, cement, aluminium, hydrogen, fertilizers, and electricity, but coverage is expected to expand to all EU ETS sectors. The first additional sectors could be added as early as 2026, possibly refining, chemicals, and other metals, all of which were included in early drafts of the legislation.

As we explained in depth in our first article, companies that must comply with CBAM have a two-year transition period, from October 2023 until December 2025, before CBAM is fully implemented. Below are a few key dates companies should mark on their calendars.

- January 2024 - first quarterly report due on embedded carbon in products; default values are permitted.

- July 2024 – at least 80% of the reported footprint must be based on actual values; failure to adequately report will result in fines.

- January 2025 – only EU methodology allowed for the full reported footprint. Importers must be authorized CBAM Declarants.

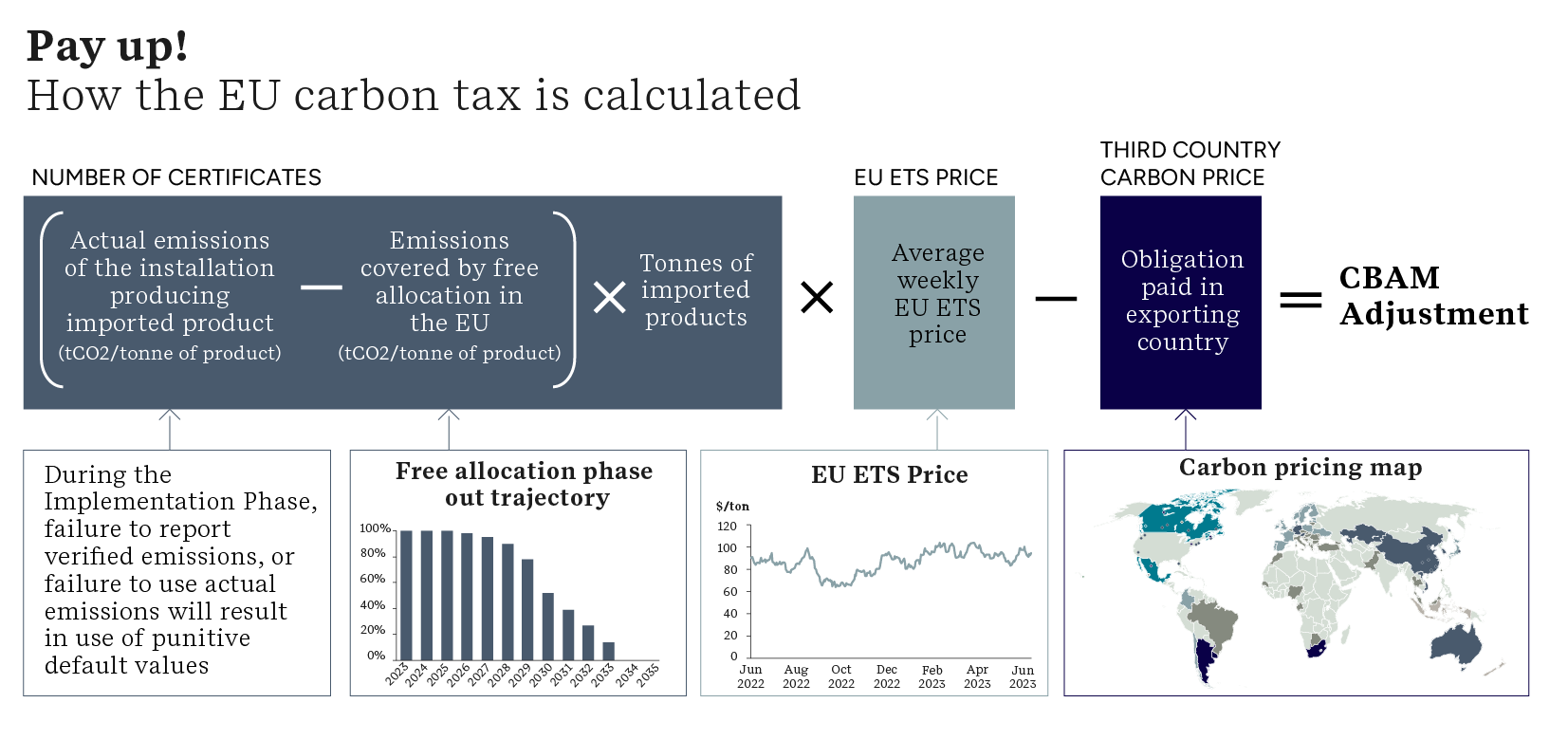

- January 2026 - full implementation of CBAM, including an externally verified annual declaration and required purchasing of CBAM certificates based on net exposure (actual emission minus free allocation and carbon pricing paid in the country of origin)

- 2026 – 2034 – free allocation of emission allowances under EU ETS/CBAM will gradually go down to zero, simultaneously pushing up the costs of CBAM for importers.

The urgency of taking pro-active action

Outside of the immediate short-term compliance requirements, CBAM has some far-reaching medium and long-term implications:

- CBAM should bring a shift in thinking for many participating companies, from the need to generate a corporate GHG inventory (Scope 1&2 and ideally 3) to understanding and developing product-based GHG accounting approaches within the specific and detailed boundaries and rules of CBAM. This is not a trivial undertaking and will require a participating company or declarant to develop an approach to data integration for its full value chain to meet the requirements.

- As CBAM moves from its transition phase to the definitive phase from 2026 onwards, free allocation will decline to zero in 2034, resulting in full exposure to EU carbon pricing (Fig 1. This will require a significant shift in the corporate decarbonization strategy to reduce risks and develop a competitive advantage.

- Other countries, including the UK, are also working on introducing carbon border taxes or ETSs.

5-step process to comply with CBAM and boost broader decarbonization strategy

To thrive in a world where carbon pricing is increasingly becoming the norm, effort must be put into understanding and developing specific approaches for CBAM compliance. Below, we outline a 5-step pathway to ensure successful CBAM compliance and leverage its implementation for a clear decarbonization strategy. But first, we want to point out a few crucial key concepts specific to CBAM.

- Temporal boundaries – each step in the value chain will have an associated annual impact

- Product boundaries – existing Environmental Product Declarations (EPD) or Life Cycle Assessments (LCA) are likely to be based on a wider boundary than those used in CBAM, which is aligned to the EU ETS

- Greenhouse Gas (GHG) Accounting Rules – rules, approaches, and GHGs to be included are scheme-specific. They are also specific to CBAM goods and are not fully aligned with the construction of a traditional product carbon footprint based on standards such as ISO 14067

- Product-level accounting requires understanding the principles of wastage or shrinkage and how this increases the GHG intensity through loss of material through a value chain.

Steps 1 and 2 - identify and map your own CBAM responsibilities

As a first step, you need to understand whether CBAM applies to you and how. This is achieved by understanding the types of goods and their position within the value chain. This requires the following actions:

- Use established production management systems to perform a rapid assessment vs the CBAM product codes or groupings.

- Map the entire value chain back to the source production plant. Where there are multiple suppliers (which is likely for most manufacturing organizations), the value chain mapping needs to cover the entirety. This second step requires a little more effort, but doing so will be fundamental to setting yourself up for success.

- Establish communications upstream and downstream within your value chain on your data needs to ensure that your suppliers, in particular, are CBAM-aware and ready. In some cases, this may be the first time those suppliers have considered that CBAM may apply to them. While the ultimate importer is not responsible for the upstream information, alerting all value chain participants significantly increases the likelihood of success, particularly in July 2024.

Step 3 - planning for data collection and disclosure

There is an expectation that CBAM participants will develop a management system approach to support their compliance, including an assessment of reporting risks. A well-defined and implemented management system is crucial when external data disclosures are required, including verification/assurance. Such a system reduces the risk of error, establishes transparent processes for a consistent outcome, and supports verification by demonstrating the links to how the regulatory requirements have been met.

The management system approach needs to be concerned with two aspects. First, how might the entities' existing data processes be leveraged to support CBAM? Second, how do the outputs need to be “sliced and diced” for CBAM purposes while maintaining data integrity? It is also important to document the approach and train personnel so the process can be repeated in the same, consistent way every quarter. To ensure this, it is also important to plan so you can meet the eventual stricter requirements of the implementation phase.

Within your system, you must also understand and include how this maps to your product-based accounting approaches. Besides that, you need to understand and include how you account for emissions embedded in incoming precursors and outgoing by-products, as well as shrinkage or wastage.

The final part of the Plan step is to work with the supply chain to ensure that their data will be available promptly and to define and document how it will be integrated into your own data for onward reporting. Although the EU will be defining default values, remember that these can only be used to estimate less than 20% of the overall footprint from July 2024 onwards and are punitive in nature. For example, the default value for crude steel is 2.51 tonneCO2/tonne steel vs an industry average of approximately 1.9 tonneCO2/tonne steel.

Step 4 - collection and integrating CBAM data

Successfully responding to CBAM requires understanding some simple key concepts around which the management systems and data-gathering tool can be built, as outlined above. In step 4, we implement the systematic approach developed in the previous stage.

This step involves collecting and analyzing operational data to calculate the previous year’s annualized CBAM footprint since CBAM is based on an annual temporal boundary. For example, an annual product intensity for 2023 will be used to fulfill onward reporting obligations in 2024.

The second part of this step is consolidating incoming data from the supply chain with the outward reporting requirements, using the volumes moving into the EU and intensity data on a 3-month basis in the initial reporting phase. This data should be readily available through production accounting and financial record-keeping systems.

Step 5 - reporting

Initially, it may be possible to use the default values published by the EU to meet the reporting requirements in a simplified approach. Ultimately, however, companies will need to be able to manage the potentially vast quantities of data effectively in the more complex and non-integrated value chains, as the ability to use the default values is restricted after June 2024.

This then introduces the challenge of using a “single source of truth” to meet multiple compliance and disclosure requirements, which may be best achieved ultimately through the effective use of digital systems to automate repeat calculations and data integration.

Case study: how CBAM provides a significant decarbonization level in the steel sector

It’s tempting to see CBAM as a narrow, compliance-based issue, especially in the short term. However, in the longer term, companies subject to CBAM should see it as an opportunity to generate a deep understanding of their supply chain impact and use this to inform their low-carbon economy transition strategy and decarbonization planning. This would create a clear economic advantage. Below, a look at the steel sector, to illustrate how a proactive approach would promote decarbonization or, in case of inaction, how compliance costs would rise.

Assumptions underpinning our case study

For simplicity’s sake, we have fixed both carbon pricing and benchmark levels in this example. We assume the EU ETS/CBAM pricing and the established EU ETS benchmarks will be the basis for free allocation levels in CBAM calculations and how free allocation will decline to zero over time.

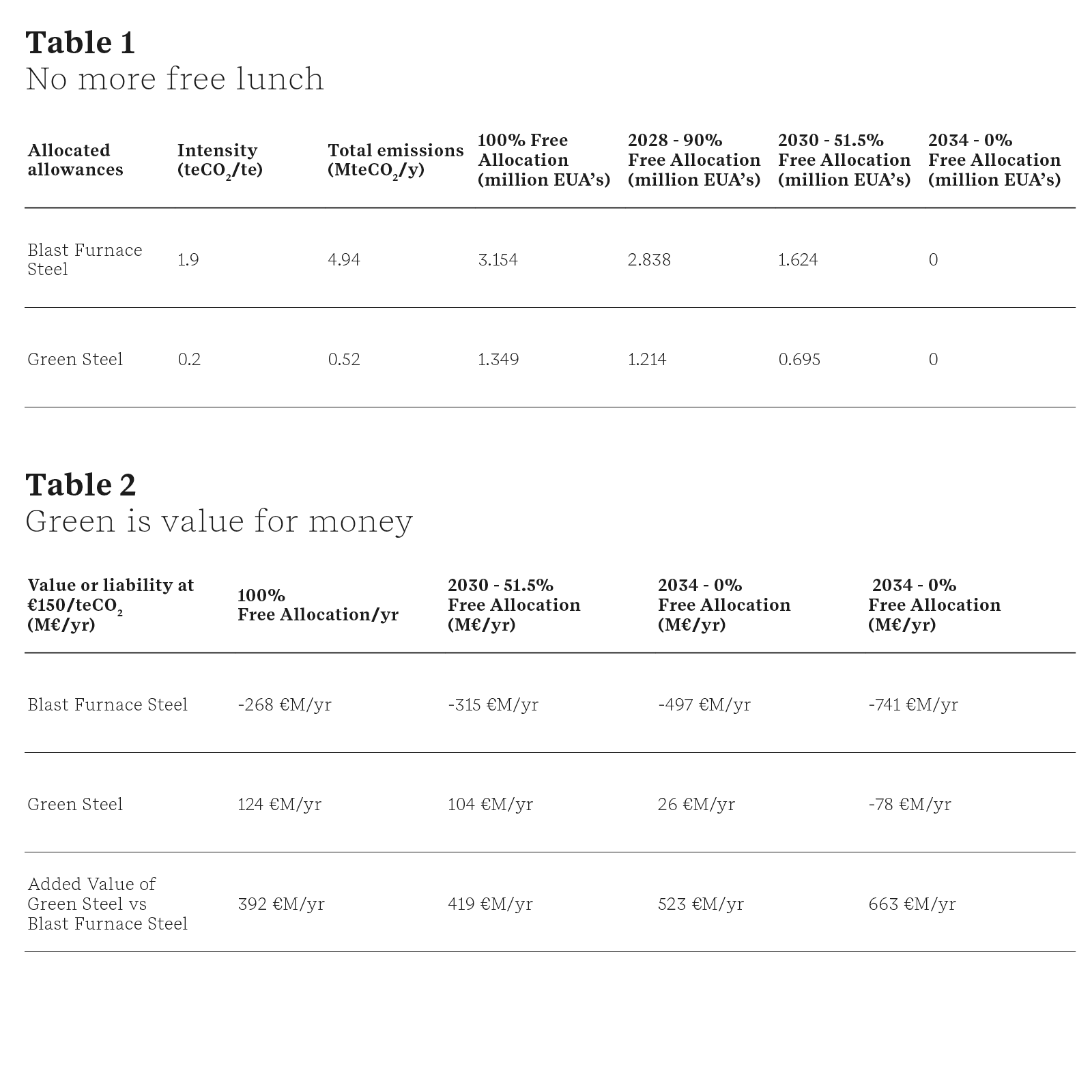

Our example is based on a hypothetical steel mill producing 2.5 million tonnes of hot-rolled coil steel (HRC) per annum. We have assumed an input of 2.6 million tonnes of raw steel per annum, produced using either metallurgical coke (Blast Furnace Steel) or green hydrogen (Green Direct Reduction Iron (DRI) Steel). Our example uses the following inputs for each production route based on industry averages and modeled data.

- Blast Furnace Steel = 1.9 tonneCO2/tonne crude steel produced

- Green Steel = 0.2 tonneCO2/tonne crude steel produced

- We have applied the relevant EU benchmarks to each process.

- We assume 25% scrap metal input for both routes

And the winner is…..Green Steel

The impact of each production route and the value or liability this could represent is shown in Tables 1 and 2 below. Table 1 shows the estimated emissions and varying levels of free allocation (million tonnes CO2 / allowances). Table 2 covers the potential cost of compliance and value differential (million euros per year), assuming that excess allocation is also sold at this price.

The tables show that Green Steel is good for business. Even though Green Steel will eventually incur a cost of compliance, since it still comes with some emissions, the cost of maintaining the use of Blast Furnace Steel is downright punitive from a CBAM perspective. Green steel has a CBAM cost advantage right from the start, its value almost doubling over time. The example clearly demonstrates that effective industrial decarbonization is a value-adding strategy in a world of increasing compliance-based carbon pricing.

Author contacts

David Neilson, Associate Technical Partner Climate Change - David.Neilson@erm.com

Richard Betts, Consulting Partner Climate Change - Richard.betts@erm.com

Clive Abel, Principal Consultant Climate Change - Clive.Abel@erm.com

Alex Kauffmann, Senior Consultant Sustainable Energy Solutions - Alex.Kauffmann@erm.com